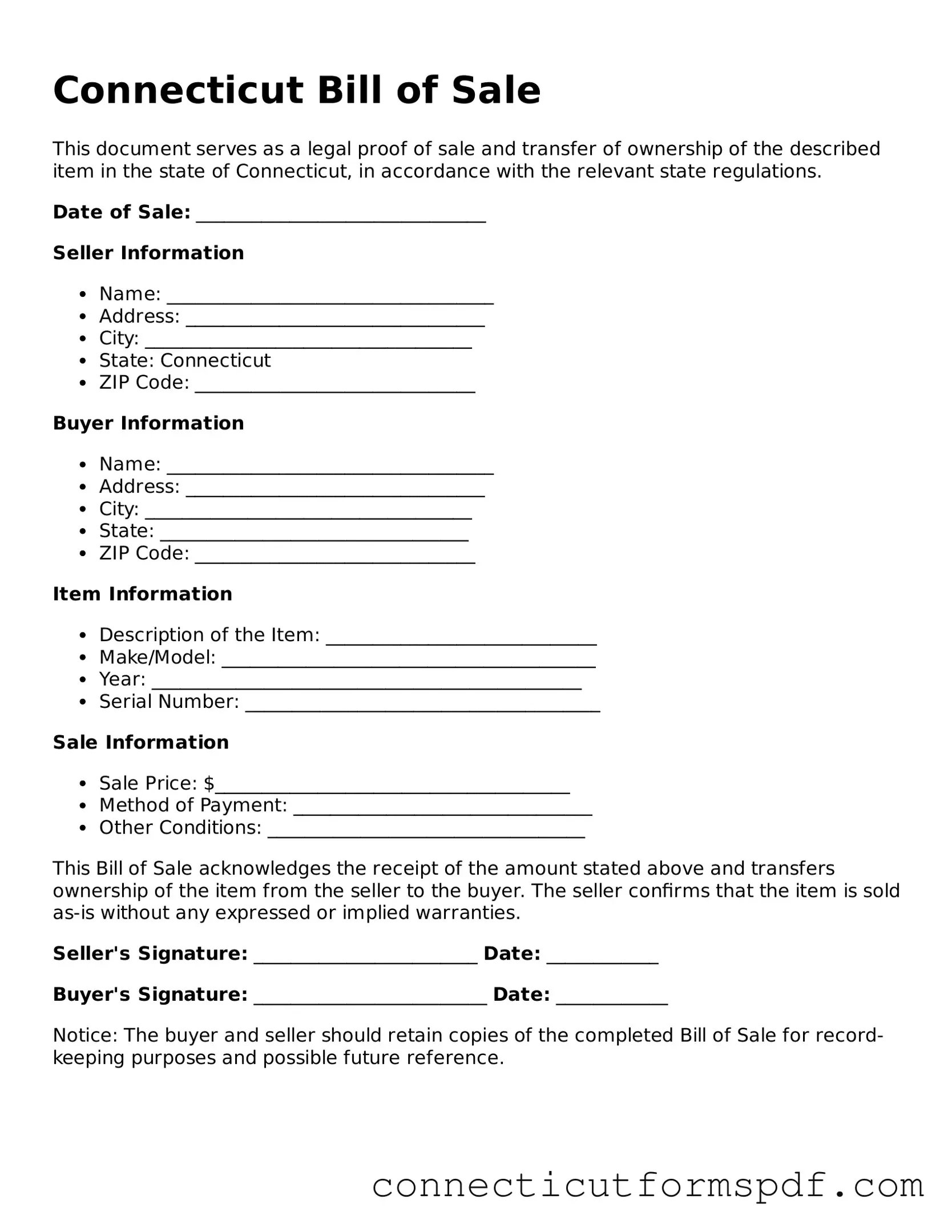

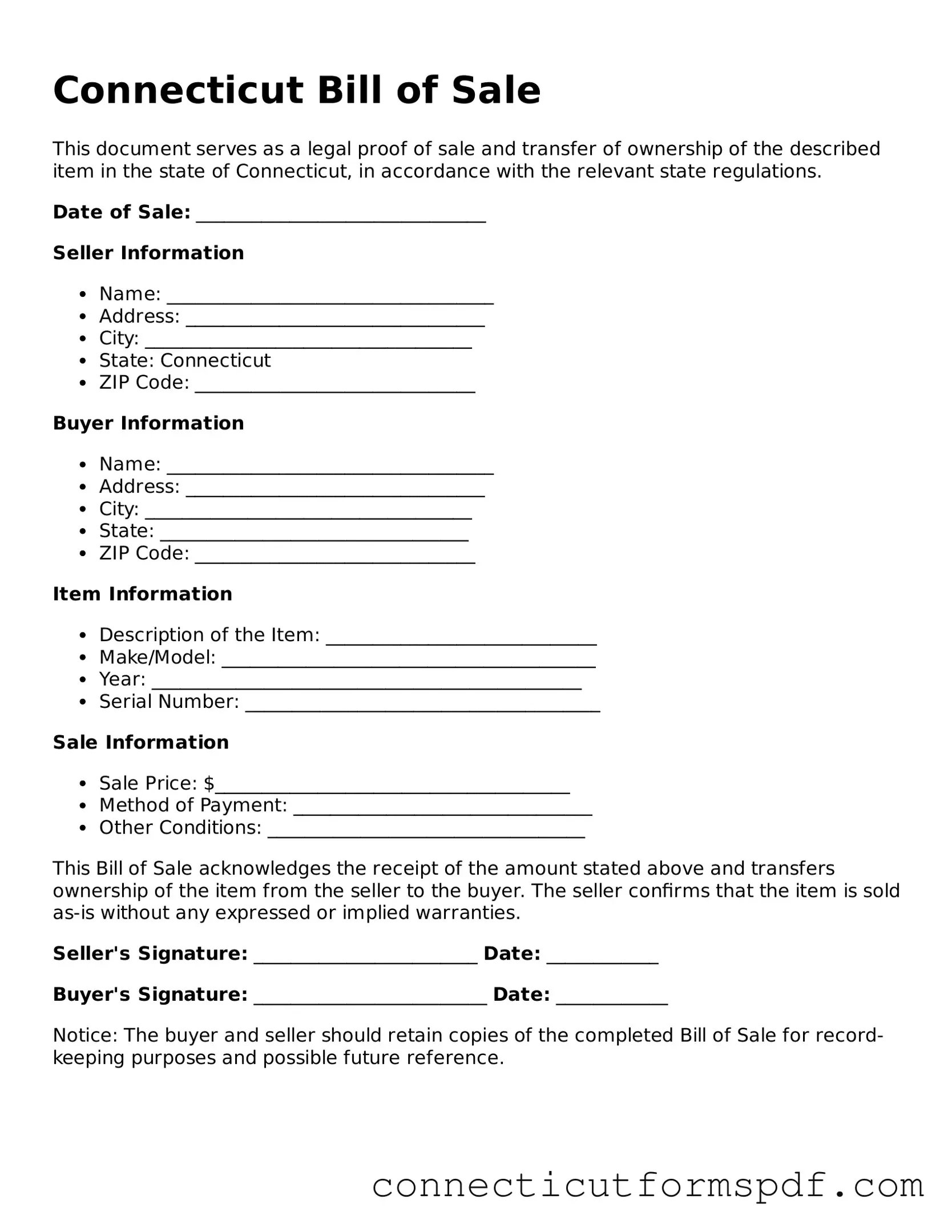

Connecticut Bill of Sale Form

A Connecticut Bill of Sale form serves as a legal document to record the sale and transfer of ownership of personal property from a seller to a buyer in the state of Connecticut. It acts as a vital record, providing proof of the transaction and details about the items sold, including their description and price. To ensure the sale is recognized legally, it's important to accurately fill out and retain a copy of the form. Discover the convenience of completing your Connecticut Bill of Sale by clicking the button below.

Launch Editor Now

Connecticut Bill of Sale Form

Launch Editor Now

Launch Editor Now

or

Click for Bill of Sale PDF

Your form is not complete yet

Edit and complete Bill of Sale online in just a few steps.