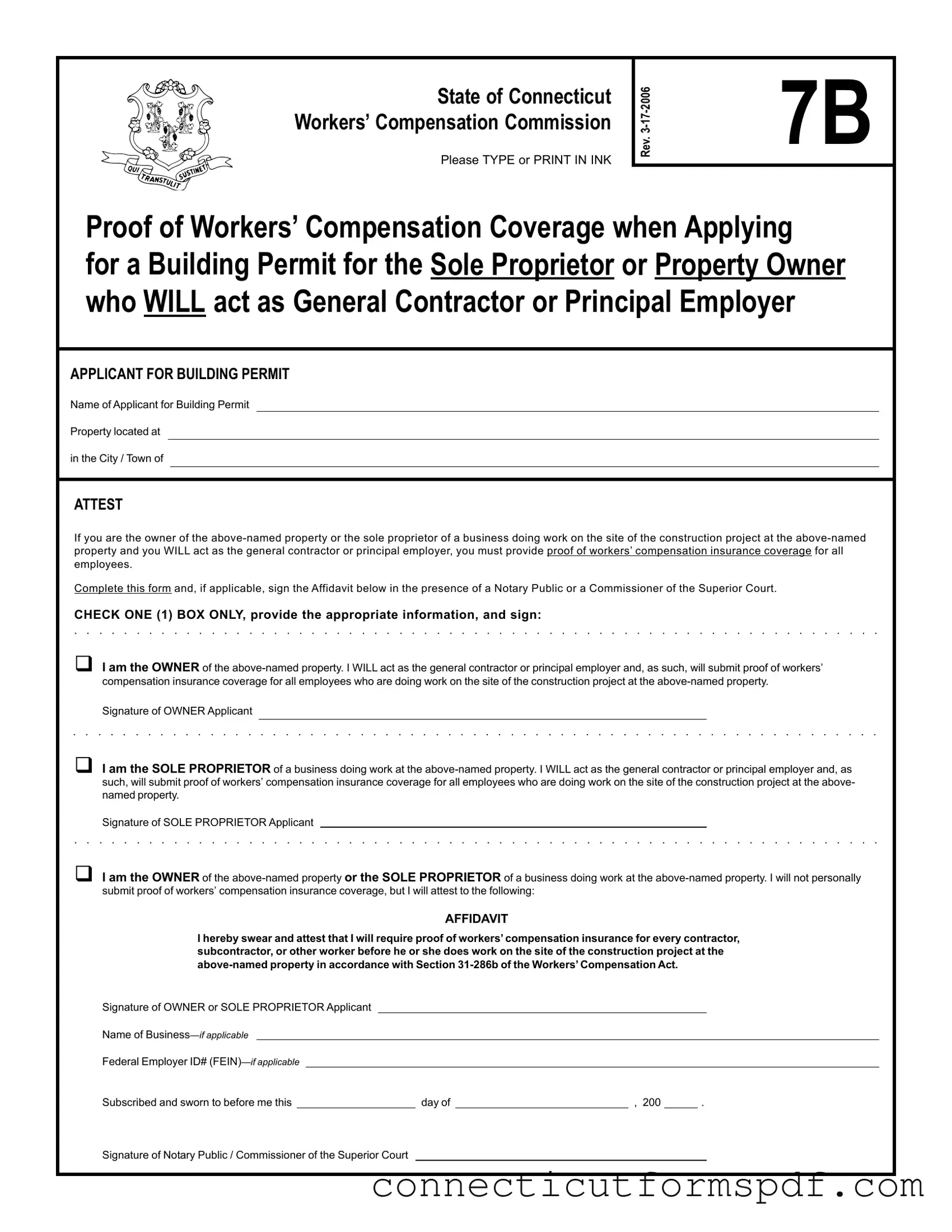

Fill Out a Valid Connecticut 7B Template

The Connecticut 7B form is essential for sole proprietors or property owners in Connecticut who intend to serve as their own general contractor or principal employer on a construction project. It serves as proof of workers’ compensation insurance for all employees involved in the project. If you're planning to apply for a building permit under these circumstances, completing this form is a critical step in ensuring compliance with state requirements.

To begin filling out your Connecticut 7B form, click the button below.

Launch Editor Now

Fill Out a Valid Connecticut 7B Template

Launch Editor Now

Launch Editor Now

or

Click for Connecticut 7B PDF

Your form is not complete yet

Edit and complete Connecticut 7B online in just a few steps.