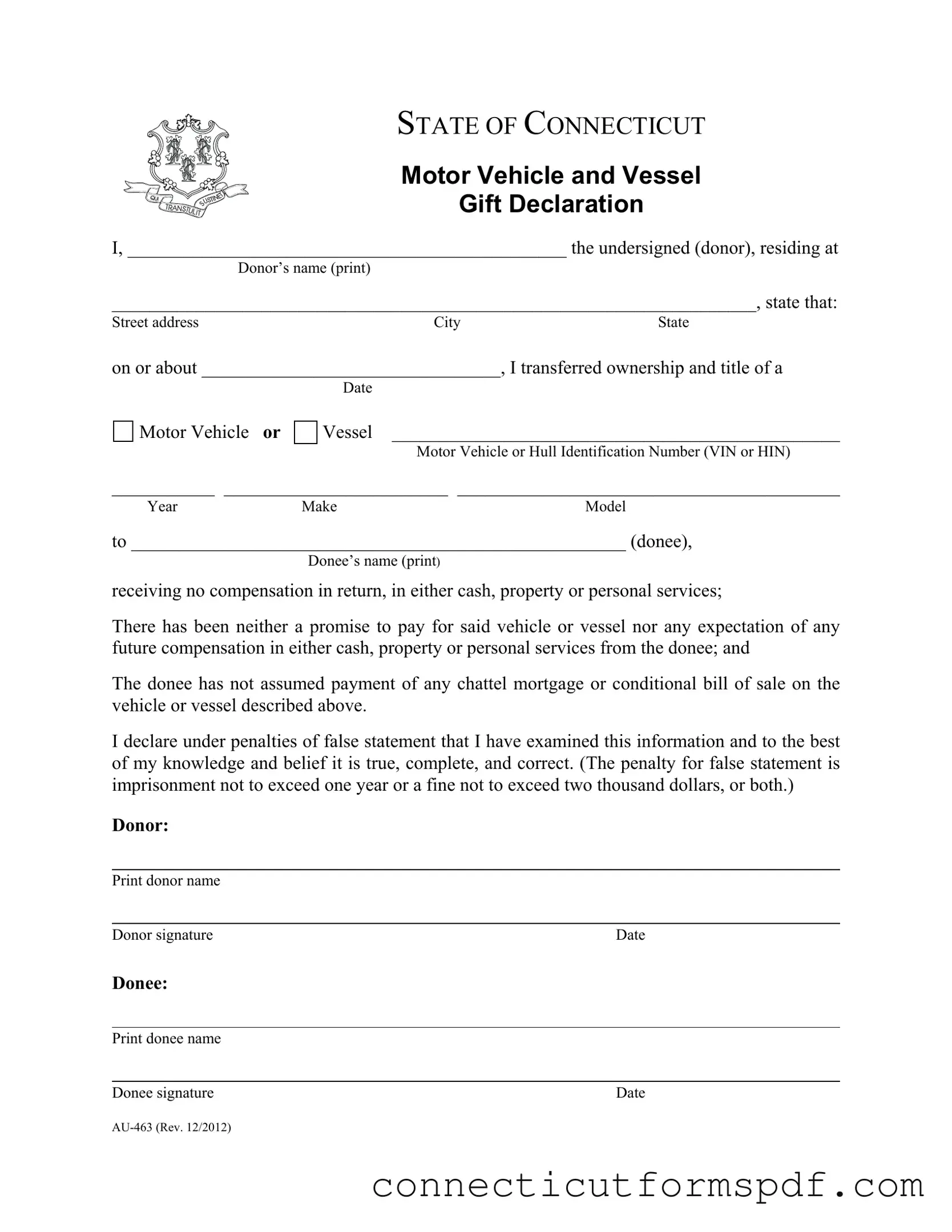

The Connecticut AU-463 form, utilized in the process of gifting a motor vehicle or vessel, bears similarity to several other forms and documents that are used for transferring ownership without traditional sales transactions. These documents facilitate the legal transfer of property while ensuring compliance with specific regulations and taxation laws. Each similar document serves a particular purpose and is tailored for different circumstances or jurisdictions, yet shares common elements with the Connecticut AU-463 form in terms of structure, required information, and legal implications.

1. Affidavit of Motor Vehicle Gift Transfer (Texas Form 14-317)

In terms of purpose and requirements, the Texas Form 14-317, or the Affidavit of Motor Vehicle Gift Transfer, is quite akin to the Connecticut AU-463 form. Both documents are designed for the specific use of recording the gift transfer of a vehicle without financial consideration between the donor and the donee. The similarities include:

- Identification of both the donor and donee by name and address.

- Specification of the type of vehicle, including details such as year, make, and model, and an identification number (VIN for vehicles, HIN for vessels).

- A declaration that the transfer is a gift, implying no payment was received or expected in return.

- Statements regarding the assumption of any existing loans or encumbrances on the gifted property.

- Legal attestations to the truthfulness of the information provided, with penalties for false statements.

Both forms serve as essential documents to facilitate the transfer of ownership in a way that is recognized by their respective state laws, effectively exempting the transfer from sales taxes, given that certain conditions are met.

2. California DMV Statement of Facts (REG 256)

The California Department of Motor Vehicles' Statement of Facts (REG 256) form shares some key aspects with the Connecticut AU-463 form, despite its broader utility. While the REG 256 can be used for a variety of declarations to the DMV, one of its functions includes the facilitation of vehicle gifts, comparable to what the AU-463 form does. Similarities include:

- The necessity to provide detailed information about the vehicle or vessel being transferred, such as the VIN or HIN.

- Sections that allow the donor to declare that the vehicle is being given as a gift, which, like the AU-463 form, requires an assertion that no money or other forms of compensation were exchanged.

- Acknowledgment of potential tax implications or exemptions as a result of the vehicle being gifted.

- A portion for the donor and donee to assert the accuracy of the information provided under the penalty of perjury.

While it offers much more in terms of functionality, the REG 256 when used in the context of gift declaration, mirrors the intent and requirements of the Connecticut AU-463, emphasizing the legal transfer of ownership without a traditional exchange of value.