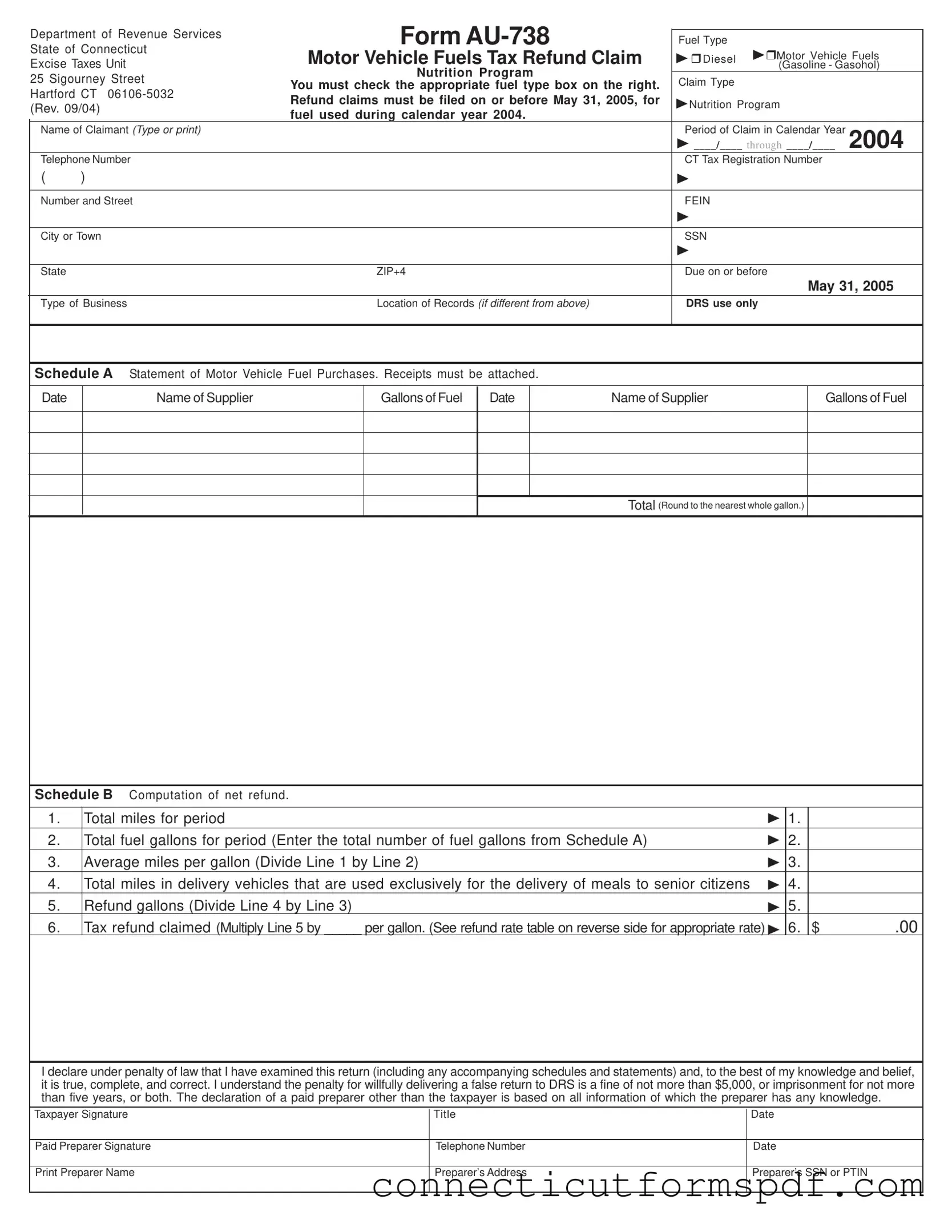

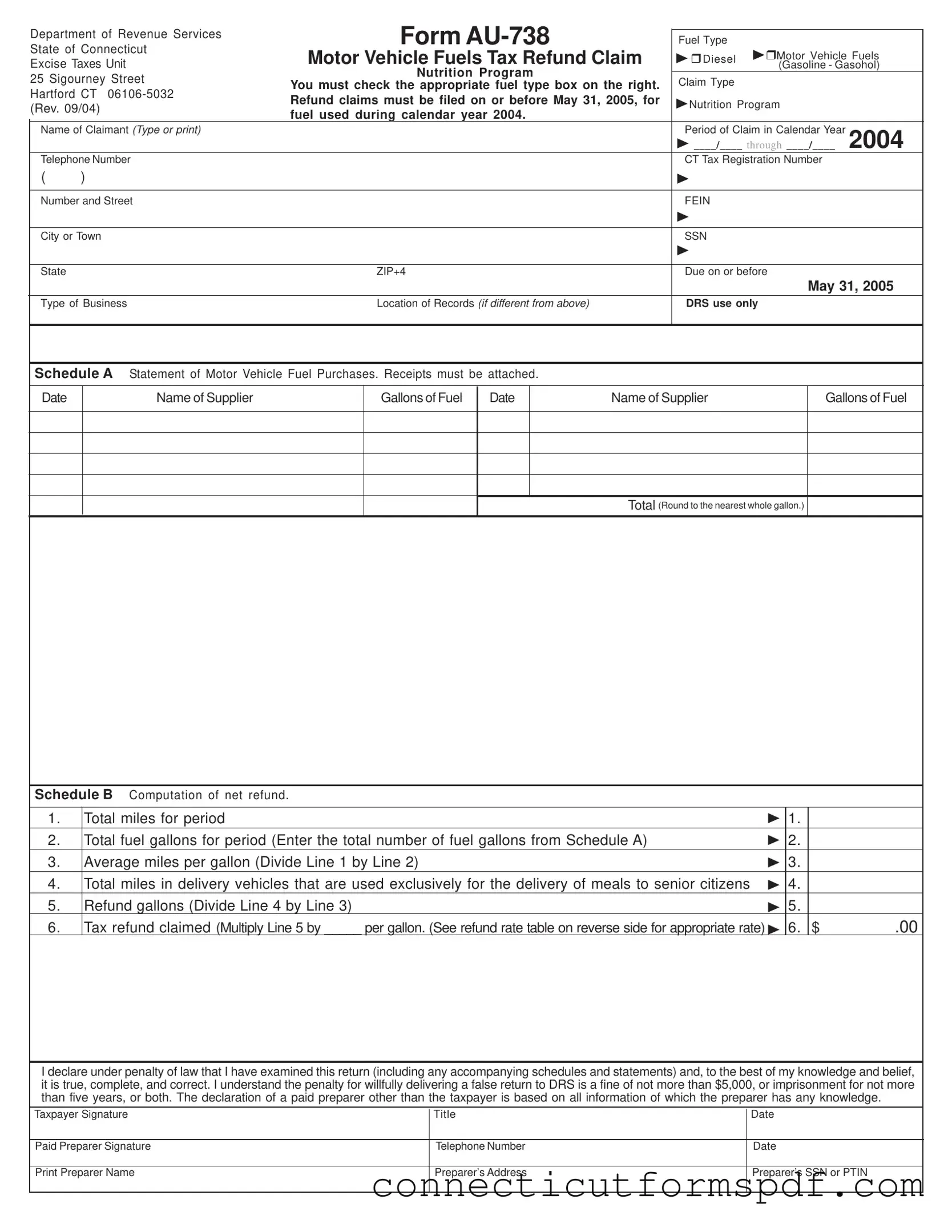

Fill Out a Valid Connecticut Au 738 Template

The Connecticut AU-738 form is a document issued by the Department of Revenue Services for claiming motor vehicle fuels tax refunds. It is specifically designed for those who have used diesel or gasoline, including gasohol, in their motor vehicles and are seeking a refund for taxes paid on these fuels. In order to successfully process a claim, applicants must select the appropriate type of fuel, file the claim by the specified deadline, and ensure all necessary documentation and receipts are attached. For guidance on completing and submitting this form, click the button below.

Launch Editor Now

Fill Out a Valid Connecticut Au 738 Template

Launch Editor Now

Launch Editor Now

or

Click for Connecticut Au 738 PDF

Your form is not complete yet

Edit and complete Connecticut Au 738 online in just a few steps.