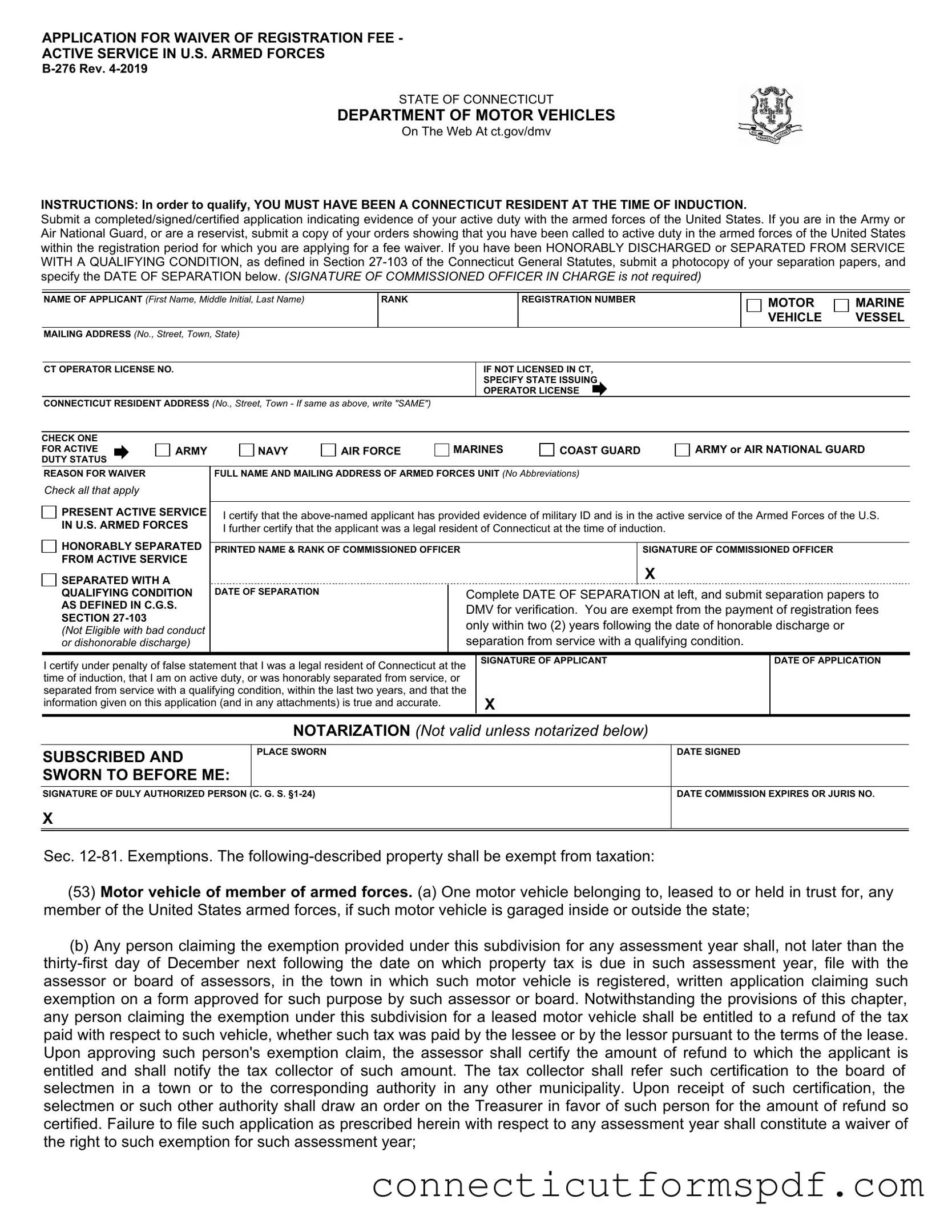

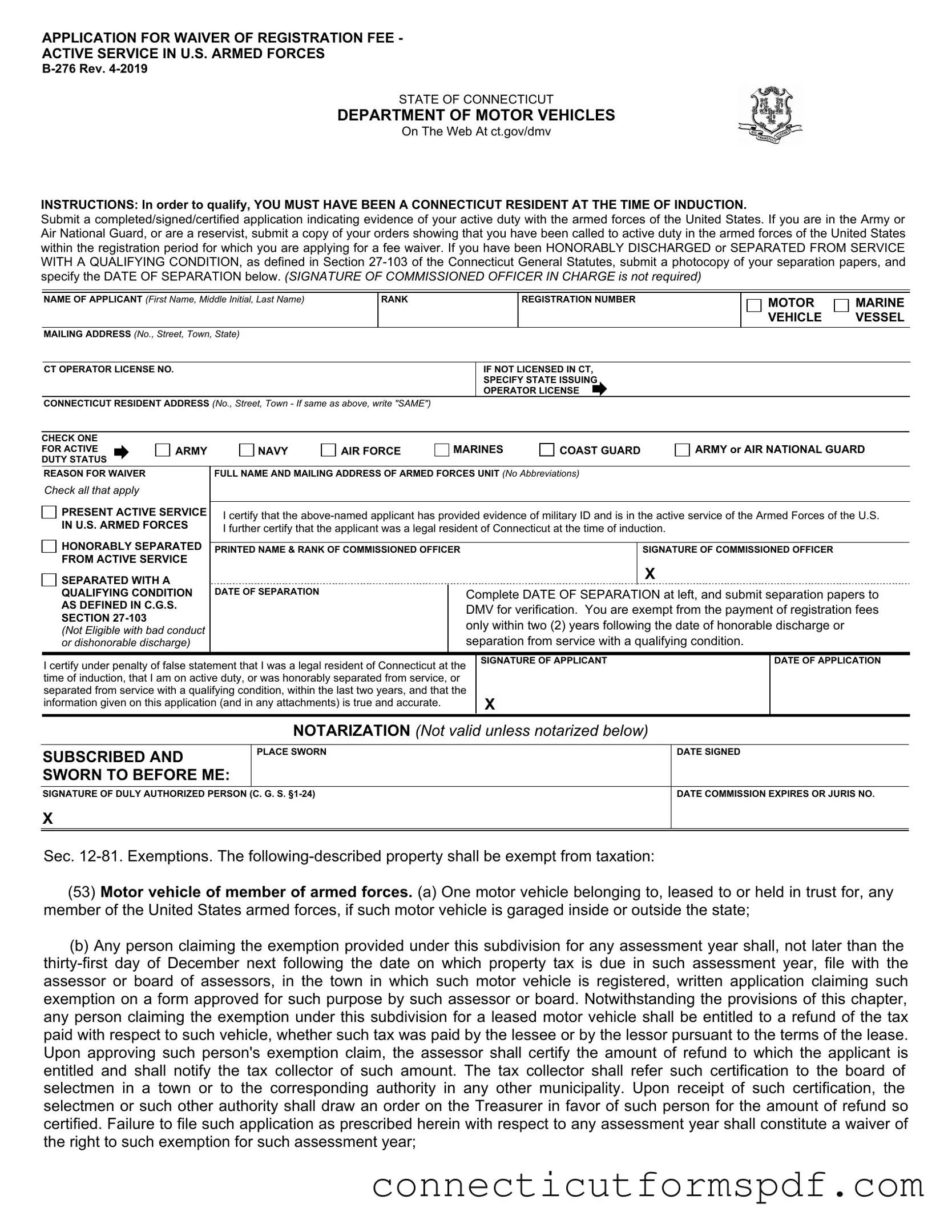

APPLICATION FOR WAIVER OF REGISTRATION FEE -

ACTIVE SERVICE IN U.S. ARMED FORCES

B-276 Rev. 4-2019

STATE OF CONNECTICUT

DEPARTMENT OF MOTOR VEHICLES

On The Web At ct.gov/dmv

INSTRUCTIONS: In order to qualify, YOU MUST HAVE BEEN A CONNECTICUT RESIDENT AT THE TIME OF INDUCTION.

Submit a completed/signed/certified application indicating evidence of your active duty with the armed forces of the United States. If you are in the Army or Air National Guard, or are a reservist, submit a copy of your orders showing that you have been called to active duty in the armed forces of the United States within the registration period for which you are applying for a fee waiver. If you have been HONORABLY DISCHARGED or SEPARATED FROM SERVICE WITH A QUALIFYING CONDITION, as defined in Section 27-103 of the Connecticut General Statutes, submit a photocopy of your separation papers, and specify the DATE OF SEPARATION below. (SIGNATURE OF COMMISSIONED OFFICER IN CHARGE is not required)

NAME OF APPLICANT (First Name, Middle Initial, Last Name)

MAILING ADDRESS (No., Street, Town, State)

CT OPERATOR LICENSE NO. |

IF NOT LICENSED IN CT, |

|

SPECIFY STATE ISSUING |

|

OPERATOR LICENSE |

CONNECTICUT RESIDENT ADDRESS (No., Street, Town - If same as above, write "SAME") |

|

CHECK ONE FOR ACTIVE DUTY STATUS

ARMY or AIR NATIONAL GUARD

|

REASON FOR WAIVER |

FULL NAME AND MAILING ADDRESS OF ARMED FORCES UNIT (No Abbreviations) |

|

|

|

Check all that apply |

|

|

|

|

|

|

|

|

|

PRESENT ACTIVE SERVICE |

|

|

|

|

|

|

|

|

|

I certify that the above-named applicant has provided evidence of military ID and is in the active service of the Armed Forces of the U.S. |

|

IN U.S. ARMED FORCES |

|

I further certify that the applicant was a legal resident of Connecticut at the time of induction. |

|

|

|

|

|

|

|

HONORABLY SEPARATED |

|

|

|

|

|

|

|

|

|

PRINTED NAME & RANK OF COMMISSIONED OFFICER |

|

|

SIGNATURE OF COMMISSIONED OFFICER |

|

FROM ACTIVE SERVICE |

|

|

|

|

|

|

|

|

|

SEPARATED WITH A |

|

|

|

|

|

X |

|

|

|

QUALIFYING CONDITION |

DATE OF SEPARATION |

|

Complete DATE OF SEPARATION at left, and submit separation papers to |

|

AS DEFINED IN C.G.S. |

|

|

|

DMV for verification. You are exempt from the payment of registration fees |

|

SECTION 27-103 |

|

|

|

|

|

|

|

only within two (2) years following the date of honorable discharge or |

|

(Not Eligible with bad conduct |

|

|

|

|

|

|

|

separation from service with a qualifying condition. |

|

or dishonorable discharge) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify under penalty of false statement that I was a legal resident of Connecticut at the |

|

SIGNATURE OF APPLICANT |

|

DATE OF APPLICATION |

|

time of induction, that I am on active duty, or was honorably separated from service, or |

|

|

|

|

|

|

separated from service with a qualifying condition, within the last two years, and that the |

|

|

|

|

information given on this application (and in any attachments) is true and accurate. |

|

X |

|

|

|

|

|

NOTARIZATION (Not valid unless notarized below) |

|

|

|

|

|

|

|

|

|

|

|

SUBSCRIBED AND |

|

PLACE SWORN |

|

|

|

DATE SIGNED |

|

|

|

|

|

|

|

|

|

|

SWORN TO BEFORE ME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF DULY AUTHORIZED PERSON (C. G. S. §1-24) |

|

|

|

DATE COMMISSION EXPIRES OR JURIS NO. |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sec. 12-81. Exemptions. The following-described property shall be exempt from taxation:

(53)Motor vehicle of member of armed forces. (a) One motor vehicle belonging to, leased to or held in trust for, any member of the United States armed forces, if such motor vehicle is garaged inside or outside the state;

(b)Any person claiming the exemption provided under this subdivision for any assessment year shall, not later than the thirty-first day of December next following the date on which property tax is due in such assessment year, file with the assessor or board of assessors, in the town in which such motor vehicle is registered, written application claiming such exemption on a form approved for such purpose by such assessor or board. Notwithstanding the provisions of this chapter, any person claiming the exemption under this subdivision for a leased motor vehicle shall be entitled to a refund of the tax paid with respect to such vehicle, whether such tax was paid by the lessee or by the lessor pursuant to the terms of the lease. Upon approving such person's exemption claim, the assessor shall certify the amount of refund to which the applicant is entitled and shall notify the tax collector of such amount. The tax collector shall refer such certification to the board of selectmen in a town or to the corresponding authority in any other municipality. Upon receipt of such certification, the selectmen or such other authority shall draw an order on the Treasurer in favor of such person for the amount of refund so certified. Failure to file such application as prescribed herein with respect to any assessment year shall constitute a waiver of the right to such exemption for such assessment year;

MOTOR

MOTOR  MARINE VEHICLE VESSEL

MARINE VEHICLE VESSEL