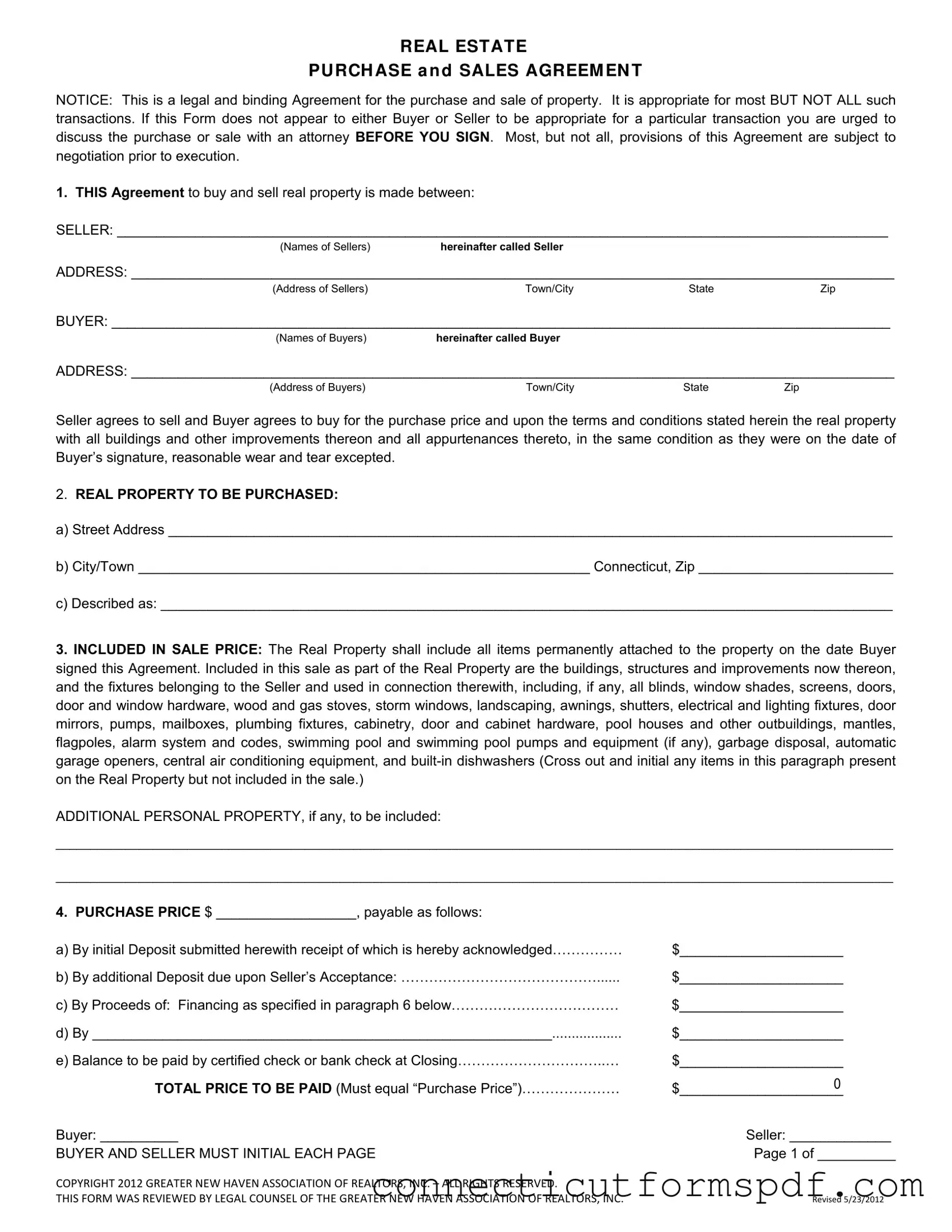

REAL ESTATE

PU RCH ASE A N D SALES AGREEM EN T

NOTICE: This is a legal and binding Agreement for the purchase and sale of property. It is appropriate for most BUT NOT ALL such transactions. If this Form does not appear to either Buyer or Seller to be appropriate for a particular transaction you are urged to discuss the purchase or sale with an attorney BEFORE YOU SIGN. Most, but not all, provisions of this Agreement are subject to negotiation prior to execution.

1.THIS Agreement to buy and sell real property is made between:

SELLER: ___________________________________________________________________________________________________

(Names of Sellers) hereinafter called Seller

ADDRESS: __________________________________________________________________________________________________

(Address of Sellers)Town/CityStateZip

BUYER: ____________________________________________________________________________________________________

(Names of Buyers) hereinafter called Buyer

ADDRESS: __________________________________________________________________________________________________

(Address of Buyers) |

Town/City |

State |

Zip |

Seller agrees to sell and Buyer agrees to buy for the purchase price and upon the terms and conditions stated herein the real property with all buildings and other improvements thereon and all appurtenances thereto, in the same condition as they were on the date of Buyer’s signature, reasonable wear and tear excepted.

2.REAL PROPERTY TO BE PURCHASED:

a)Street Address _____________________________________________________________________________________________

b)City/Town __________________________________________________________ Connecticut, Zip _________________________

c)Described as: ______________________________________________________________________________________________

3.INCLUDED IN SALE PRICE: The Real Property shall include all items permanently attached to the property on the date Buyer signed this Agreement. Included in this sale as part of the Real Property are the buildings, structures and improvements now thereon, and the fixtures belonging to the Seller and used in connection therewith, including, if any, all blinds, window shades, screens, doors, door and window hardware, wood and gas stoves, storm windows, landscaping, awnings, shutters, electrical and lighting fixtures, door mirrors, pumps, mailboxes, plumbing fixtures, cabinetry, door and cabinet hardware, pool houses and other outbuildings, mantles, flagpoles, alarm system and codes, swimming pool and swimming pool pumps and equipment (if any), garbage disposal, automatic garage openers, central air conditioning equipment, and built-in dishwashers (Cross out and initial any items in this paragraph present on the Real Property but not included in the sale.)

ADDITIONAL PERSONAL PROPERTY, if any, to be included:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

4. PURCHASE PRICE $ __________________, payable as follows: |

|

a) By initial Deposit submitted herewith receipt of which is hereby acknowledged…………… |

$_____________________ |

b) By additional Deposit due upon Seller’s Acceptance: …………………………………… |

$_____________________ |

c) By Proceeds of: Financing as specified in paragraph 6 below……………………………… |

$_____________________ |

d) By ___________________________________________________________ |

$_____________________ |

e) Balance to be paid by certified check or bank check at Closing…………………………..… |

$_____________________ |

TOTAL PRICE TO BE PAID (Must equal “Purchase Price”)………………… |

0 |

$_____________________ |

Buyer: __________ |

Seller: _____________ |

BUYER AND SELLER MUST INITIAL EACH PAGE |

Page 1 of __________ |

COPYRIGHT 2012 GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. – ALL RIGHTS RESERVED. |

|

THIS FORM WAS REVIEWED BY LEGAL COUNSEL OF THE GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. |

REVISED 5/23/2012 |

5.DEPOSITS: The Deposit(s) specified above shall be made at the stated times. All Deposits shall be made by check, payable to the Listing Broker and shall be deposited as required under Connecticut General Statutes Section 20-324k. All checks are subject to collection and failure of collection shall constitute a default. Except at time of closing, when the Deposit shall be delivered to Seller or Seller’s designee, the Listing Broker shall not pay the Deposit to anyone without the written consent of all parties to this Agreement subject to Connecticut General Statutes Section 20-324k(d). In the event any Deposit funds payable pursuant to this Agreement are not paid by Buyer, Seller may give written notice of such failure to Buyer. If such notice is given and a period of 3 (three) days pass without Buyer paying the Deposit owed, Seller may declare Buyer in default and shall have the remedies set forth in Paragraph 14.

6.FINANCING CONTINGENCY:

a) Amount $_______________ |

b) Maximum Initial Interest Rate __________% |

|

c) Term: ____________ years |

d) Commitment Date: _________________________ |

|

e) Type: Conventional Fixed |

Variable |

FHA |

VA |

CHFA |

Other___________________________ |

Buyer’s obligation is contingent upon Buyer obtaining financing as specified in this paragraph. Buyer agrees to apply for such financing immediately and diligently pursues a written mortgage commitment on or before the Commitment Date.

f)If Buyer is unable to obtain a written commitment and notifies Seller in writing by 5:00 PM on or before said Commitment Date, this Agreement shall be null and void and any Deposits shall be immediately returned to Buyer. Otherwise, the Financing Contingency shall be deemed satisfied and this Agreement shall continue in full force and effect.

7.CONDITION OF PREMISES: Buyer represents that Buyer has examined the Real Property and is satisfied with the physical condition subject to the Inspection Contingency if applicable. Neither Seller nor any representative of the Seller or Buyer has made any representation or promise other than those expressly stated herein which Buyer has relied upon in making this Agreement.

8.INSPECTION CONTINGENCY: Broker Recommends

(a)Inspections shall be completed and results reported to Seller on or before 5:00 P.M. on: _________________________.

(b)Seller agrees to permit Buyer’s designees to inspect the Real Property during the period from Seller’s acceptance until the date set forth in (a) above. If Buyer is not satisfied with the physical condition of the Real Property and so notifies Seller in writing prior to the time and date specified in (a) above, then Buyer may, at Buyer’s option, terminate this Agreement. Buyer may give Seller the option to correct the conditions that are unsatisfactory to the Buyer. Should Buyer elect to terminate this Agreement or Seller is unwilling to correct any unsatisfactory conditions, the Buyer shall notify Seller on or before 5:00 P.M. on: ________________________ of Buyer’s election to terminate this Agreement, and if Terminated this Agreement shall be null and void and any Deposit monies paid hereunder shall be returned immediately to Buyer and neither Buyer nor Seller shall have any claims against each other under the terms of this Agreement. If Buyer fails to notify Seller as provided herein, this contingency shall be deemed satisfied and this Agreement shall continue in full force and effect.

(c)If initialed below, Buyer does NOT choose to have any inspections performed and WAIVES any rights to object to any defects in the Real Property that would have been disclosed by a full and complete inspection.

Initials __________

9.LEAD-BASED PAINT. If the Property is “target housing” under federal law (meaning, with some exceptions, housing built before 1978), Seller must permit Buyer, at Buyer’s expense, a 10-day period to conduct a risk assessment or inspection of the Real Property for the presence of lead-based paint and/or lead-based paint hazards before Buyer is obligated under this Agreement. Buyer may waive this right of inspection. Buyer to provide Seller or Sellers’ attorney with written notice of the presence of defective lead-based paint or lead-based paint hazards along with a copy of the inspection and/or risk assessment within ________ days (insert “ten” or a mutually agreed number of days) of the date of acceptance of this Agreement. If such notice is given and Seller and Buyer cannot reach a mutually satisfactory agreement within seven (7) days of said notice regarding the defective lead-based paint or lead-based paint hazards, either party shall have the option of terminating this Agreement and this Agreement shall be null and void.

__________ (Initial) Buyers waive the opportunity to conduct a risk assessment or inspection for the presence of lead-based paint

and/or lead-based paint hazards.

Buyer: __________ |

Seller: _____________ |

BUYER AND SELLER MUST INITIAL EACH PAGE |

Page 2 of __________ |

COPYRIGHT 2012 GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. – ALL RIGHTS RESERVED. |

|

THIS FORM WAS REVIEWED BY LEGAL COUNSEL OF THE GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. |

REVISED 5/23/2012 |

10.PROPERTY MAINTENANCE, OCCUPANCY, POSSESSION:

(a) PROPERTY MAINTENANCE.

Seller agrees to maintain Real Property with all buildings, landscaping and other improvements thereon, all appurtenances thereto, and any personal property included in the sale in the same condition, reasonable wear and tear excepted, as it was on the date of this Agreement.

(b) OCCUPANCY, POSSESSION: CLOSING DATE: _________________________

Unless otherwise stated herein, Buyer shall receive exclusive possession and occupancy with keys on Closing Date. The Real Property shall be maintained by Seller until time of Closing and shall be transferred in broom clean condition, free of debris. Buyer shall have the right to a walk through inspection of the Property within 48 hours prior to the Closing Date. Closing shall be held at an office to be determined by Buyer’s attorney in the county where the Real Property is located or at such place as designated by Buyer’s mortgage lender.

11.WARRANTY DEED: Seller agrees to convey fee simple title of the Real Property to Buyer by a good and sufficient Warranty Deed subject only to any and all provisions of any ordinance, municipal regulation, public or private law, restrictions and easements as appear of record, if any, provided they do not affect marketability of title, current real estate taxes, water and sewer charges, and current water and sewer assessment balance, if any; except in those cases where a fiduciary’s Deed or other form of court ordered deed may be required to pass title. Seller warrants that Seller has no notice of any outstanding violations from any town, city or State agency relating to the Real Property.

12.MARKETABLE TITLE: Title to be conveyed by Seller shall be marketable as determined by the Standards of Title of the Connecticut Bar Association now in force. Seller further agrees to execute such documents as may be reasonably required by Buyer’s title insurance company or by Buyer’s mortgage lender. Should Seller be unable to convey Marketable Title as defined herein, Buyer may accept such Title as Seller can convey or may reject the Unmarketable Title, receive back all Deposit money, and declare this Agreement null and void. Upon such rejection and repayment to Buyer of all sums paid on account hereof, this Agreement shall terminate and the Parties hereto shall be released from all further claims against each other.

13.ADJUSTMENTS: Real Estate Taxes will be adjusted as of the Closing Date by the Uniform Fiscal Year basis except in the Towns of Meriden or Wallingford where taxes will be adjusted by the Assessment Year Method. All other adjustments, including Association fees, fuel oil, water and sewer usage, interest on sewer or water assessments, utilities, rent, if any, and issues regarding funds at closing and unavailability of releases at closing and like matters shall be adjusted pro rata as of the Closing Date in accordance with the Residential Real Estate Closing Customs, New Haven County, as adopted by the New Haven County Bar Association, now in force. Rent security deposits, if any, shall be credited to Buyer by Seller on the Closing Date and shall include any interest accrued to the tenant.

14.BUYER’S DEFAULT: If Buyer fails to comply with any Terms of this Agreement by the time set forth for compliance and Seller is not in default, Seller shall be entitled to all initial and additional Deposit funds provided for in section 4, whether or not Buyer has paid the same, as liquidated damages and both parties shall be relieved of further liability under this Agreement. If legal action is brought to enforce any provision of this Agreement, the prevailing party shall be entitled to reasonable attorney’s fees.

15.RISK OF LOSS, DAMAGE: All risk of loss or damage to said Real Property by fire, theft or other casualty until delivery of Deed shall be upon the Seller. In the event of loss or damage independently appraised at more than $10,000.00, Buyer shall have the option to receive any insurance payment on account of said damage and take Title, or rescind this Agreement and receive back all Deposit money paid. In such case, all rights and obligations of the parties under this Agreement shall terminate.

16.COMMON INTEREST COMMUNITY: If the property is a unit in a condominium or other common interest community, Seller will deliver the resale documents in accordance with Connecticut General Statutes Section 47-270.

17.LISTING BROKER___________________________________________________________ PH#_________________________

Dual Agent – If the Listing Agent is acting as a Dual Agent, a CONSENT FOR DUAL AGENCY FORM SHALL BE ATTACHED to this Agreement.

COOPERATING BROKER_______________________________________PH#__________________ Buyer Agent Sub Agent

Buyer: __________ |

Seller: _____________ |

BUYER AND SELLER MUST INITIAL EACH PAGE |

Page 3 of __________ |

COPYRIGHT 2012 GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. – ALL RIGHTS RESERVED. |

|

THIS FORM WAS REVIEWED BY LEGAL COUNSEL OF THE GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. |

REVISED 5/23/2012 |

18.PROPERTY CONDITION REPORT: Seller and Buyer acknowledge that if a written residential property condition report is required by statute (CT Gen. Stat. 20-327b et seq.) and Seller has not provided Buyer with the required report, Seller will credit Buyer with the sum of $500.00 at closing.

19.EQUAL HOUSING RIGHTS: Buyer acknowledges the right to be shown any property within Buyer’s stated price range in any area specified by Buyer which is available to Agent for Showing. This Agreement is Subject to Connecticut General Statutes prohibiting discrimination in commercial and residential real estate transactions (Connecticut General Statutes Title 46a, Chapter 814c).

20.NO ASSIGNMENT, BINDING EFFECT: This Agreement may not be assigned by either party without the written consent of the other, but shall be binding upon the heirs, executors, administrators and successors of the parties hereto.

21.ADDENDUM: The following attached Addenda and/or Riders are part of this Agreement:

Seller’s Property Condition Disclosure |

Agency Disclosure |

Title X Lead Based Paint Hazards Disclosure |

Dual Agency Consent

Multi-family Tenant Rider

Other____________________________________________________________________________________________________

22.ADDITIONAL TERMS AND CONDITIONS: _________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

23.FAX TRANSMISSION/ELECTRONIC MAIL: The parties acknowledge that this Agreement and any addenda or modification

and/or any notices due hereunder may be transmitted between them by facsimile machine/electronic mail and the parties intend that a faxed document or an electronic mail document containing either the original and/or copies of the parties’ signatures shall be binding and of full effect.

24.COMPLETE AGREEMENT: This Agreement contains the entire agreement between Buyer and Seller concerning this transaction and supersedes any and all previous written or oral agreements concerning the Property. Any extensions or modifications of this Agreement shall be in writing signed by the parties.

25.NOTICE: Any notice required or permitted under the Terms of this Agreement by Buyer or Seller shall be in writing addressed to the Party concerned using the address stated in Paragraph 1 of this Agreement or to such party’s attorney or to the party’s Listing Broker or Cooperating Broker designated in paragraph 17.

26. APPLICABILITY: Buyer and Seller agree and understand that although this form has been made available by the Greater New Haven Association of REALTORS, Inc. the Association assumes no responsibility for its content in relation to the transaction between the parties and is not a party to this Agreement. This Agreement or parts of it may not be suitable for all transactions or conditions. The parties should determine its applicability.

27.BUYER AND SELLER acknowledges receipt of a copy of this Agreement upon their signing same.

28.TIME TO ACCEPT: Seller shall have until ________________________________________________________ to accept this

Agreement. |

|

(Date & Eastern Standard Time) |

|

29. SIGNATURES: |

|

|

|

______________________________________________ | ___________ |

_____________________________________________ | _____________ |

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

_____________________________________________________ | ____________ |

_____________________________________________________ | _______________ |

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

_____________________________________________________ | ____________ |

_____________________________________________________ | _______________ |

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

Buyer: __________ |

Seller: _____________ |

BUYER AND SELLER MUST INITIAL EACH PAGE |

Page 4 of __________ |

COPYRIGHT 2012 GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. – ALL RIGHTS RESERVED. |

|

THIS FORM WAS REVIEWED BY LEGAL COUNSEL OF THE GREATER NEW HAVEN ASSOCIATION OF REALTORS, INC. |

REVISED 5/23/2012 |