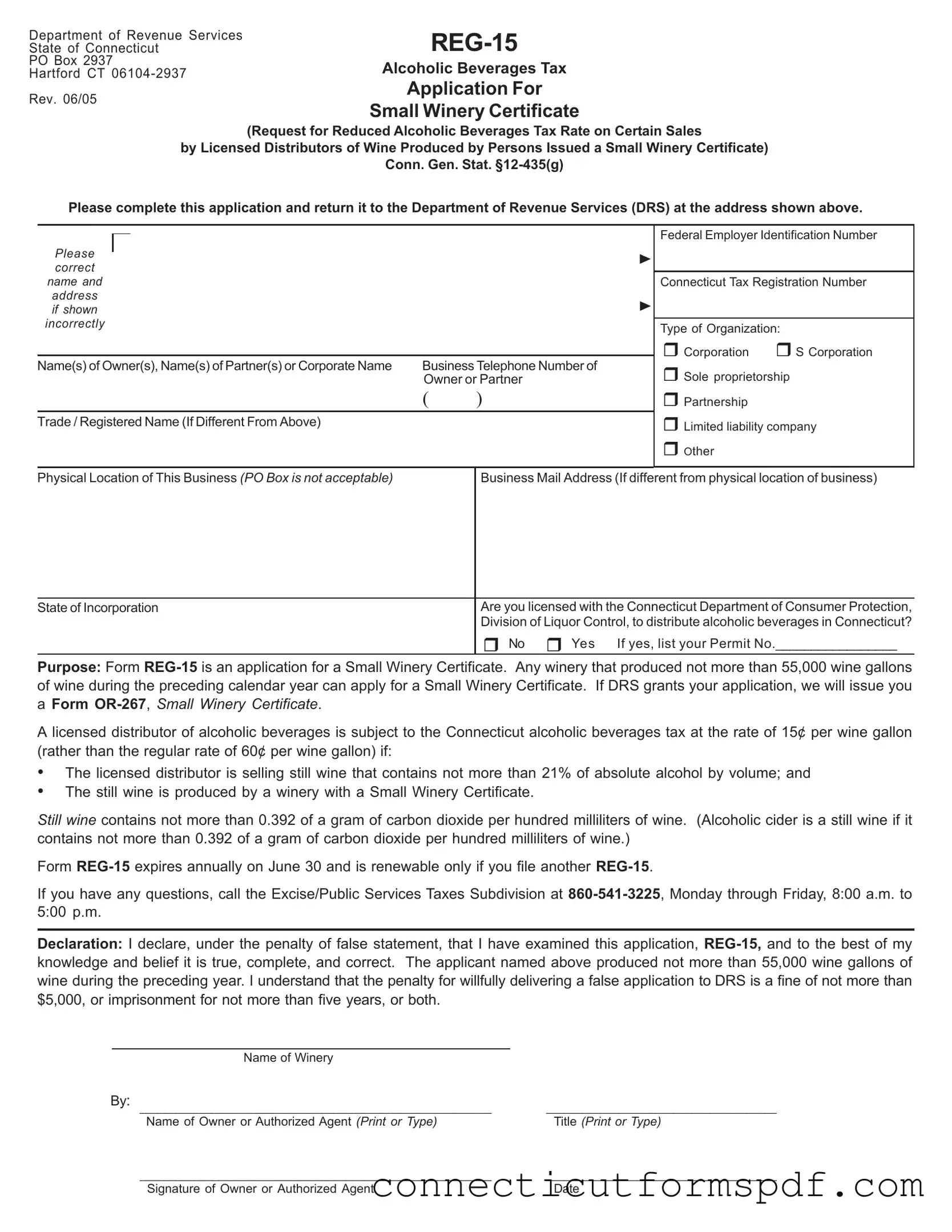

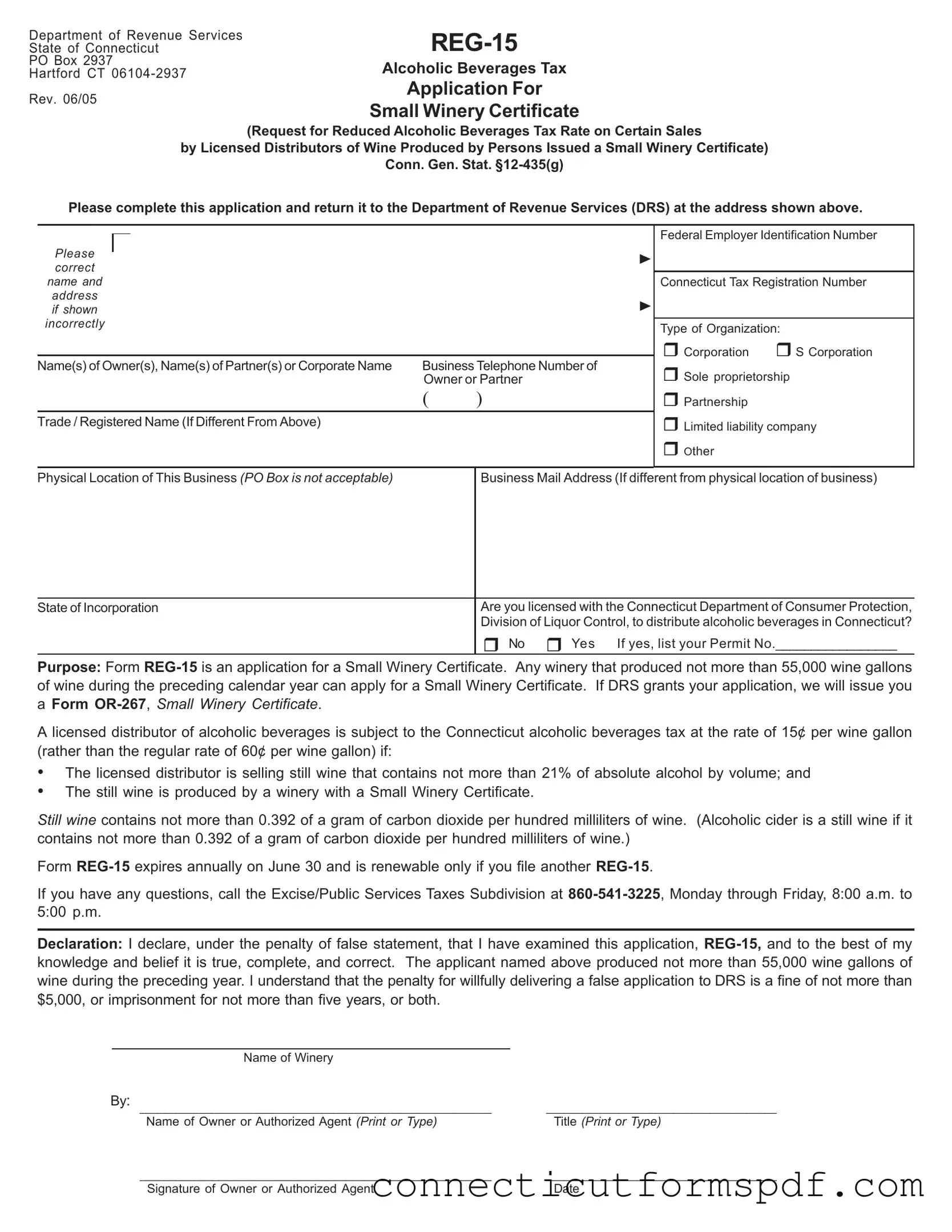

- What is the Connecticut REG-15 form?

The Connecticut REG-15 form is an application for a Small Winery Certificate, allowing qualifying wineries a reduced alcoholic beverages tax rate on certain sales by licensed distributors. This certificate benefits wineries that produced no more than 55,000 wine gallons during the preceding calendar year.

- Who needs to file this form?

Any winery that meets the production threshold of not more than 55,000 wine gallons in the last calendar year and seeks the tax benefits offered under the Small Winery Certificate should file this form.

- What are the benefits of being granted a Small Winery Certificate?

A licensed distributor of alcoholic beverages will be taxed at 15¢ per wine gallon, instead of the regular rate of 60¢ per wine gallon, when selling still wine produced by a winery holding a Small Winery Certificate. This applies to still wines with no more than 21% of absolute alcohol by volume.

- How often does the REG-15 form need to be renewed?

The REG-15 form expires annually on June 30 and must be renewed each year by submitting a new application.

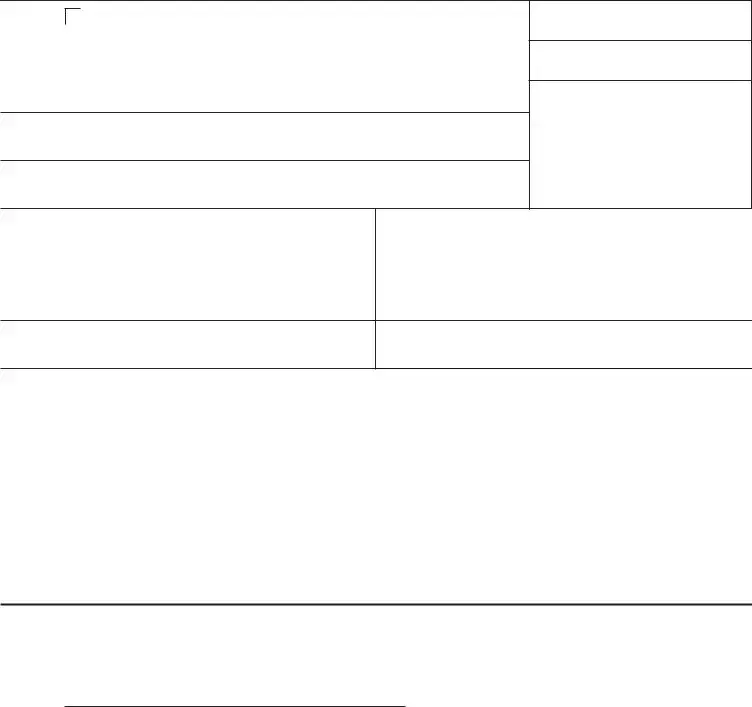

- What information is required to complete the REG-15 form?

You will need to provide the name of the owner(s) or partner(s), corporate name (if applicable), business telephone number, registered trade name, federal employer identification number, Connecticut tax registration number, type of organization, physical business location, business mailing address if different, state of incorporation, and if licensed to distribute alcoholic beverages in Connecticut, the permit number.

- Where do I submit the completed REG-15 form?

The completed form should be returned to the Department of Revenue Services at the address provided at the top of the form: PO Box 2937, Hartford CT 06104-2937.

- What happens after submitting the form?

Upon reviewing your application, if granted, the Department of Revenue Services (DRS) will issue a Small Winery Certificate, Form OR-267.

- How do I know if I qualify for a Small Winery Certificate?

Your winery qualifies for a Small Winery Certificate if it produced not more than 55,000 gallons of wine in the preceding calendar year and meets all other criteria as outlined by the Department of Revenue Services.

- What is the penalty for submitting a false REG-15 application?

Delivering a false application intentionally is subject to a penalty, which can include a fine of not more than $5,000, imprisonment for not more than five years, or both.

- Can I contact someone for questions regarding the REG-15 form?

For any questions, you can contact the Excise/Public Services Taxes Subdivision at 860-541-3225, Monday through Friday from 8:00 a.m. to 5:00 p.m.