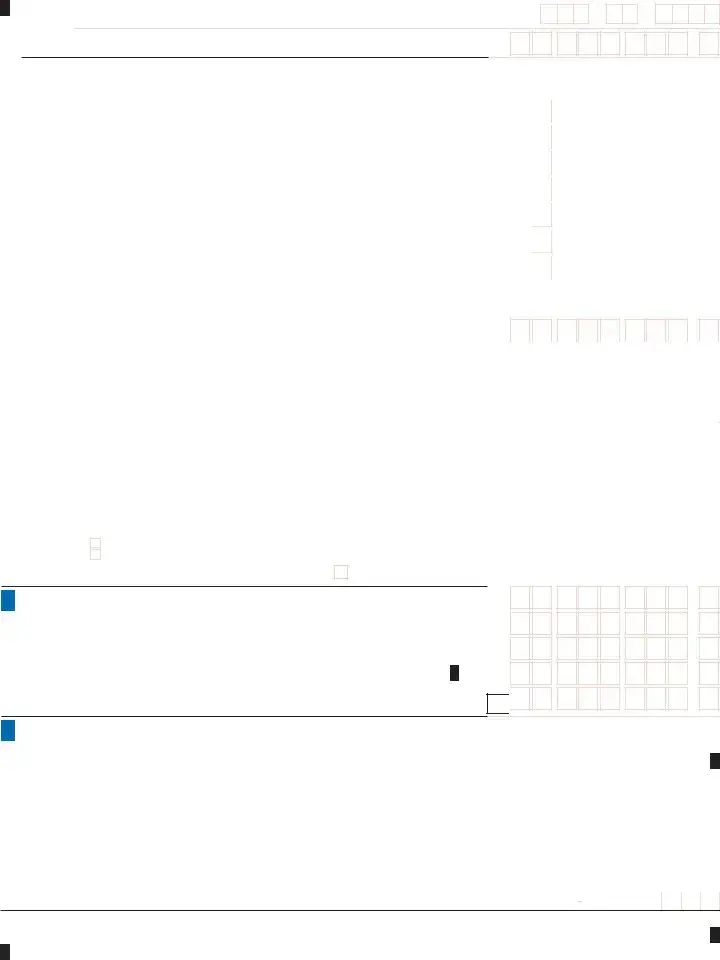

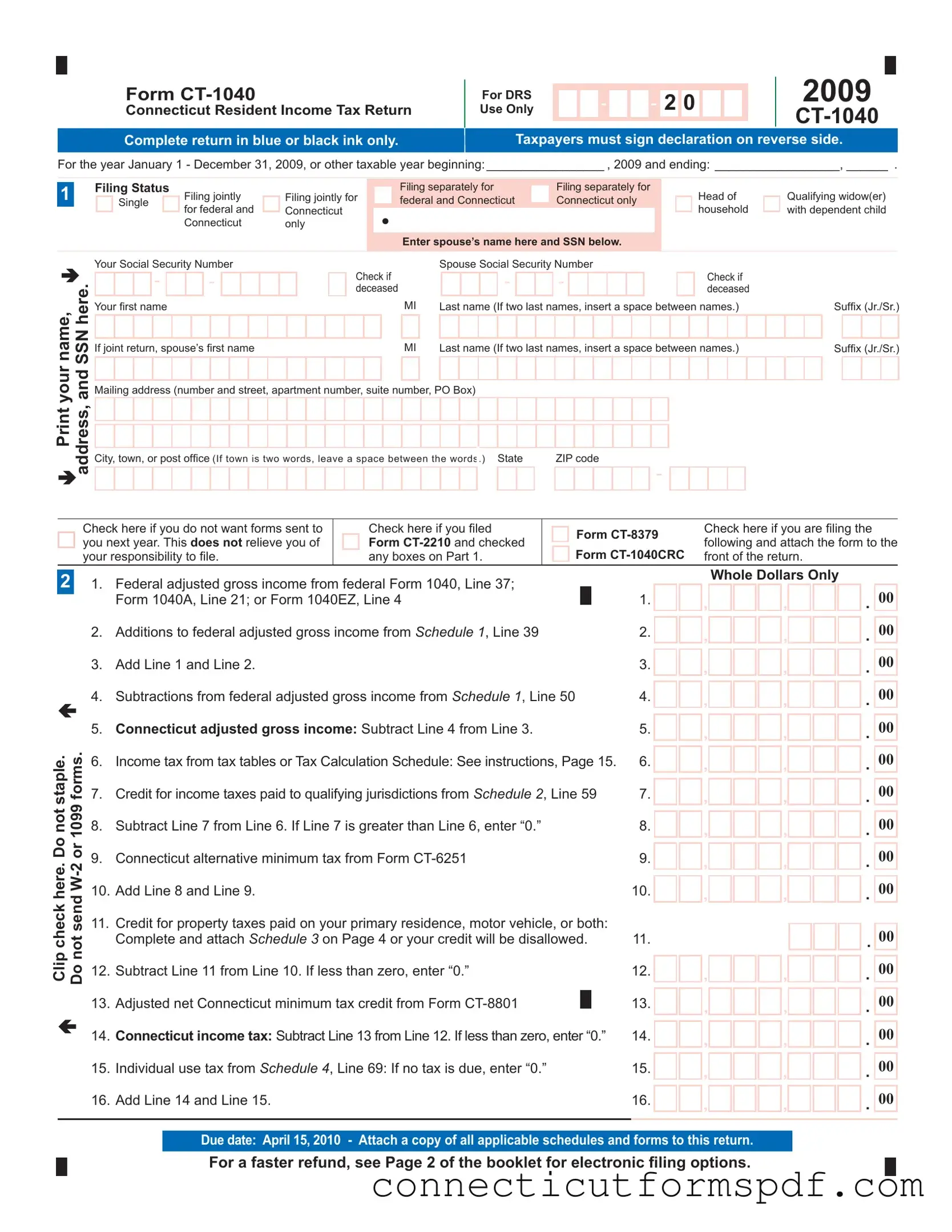

Fill Out a Valid Ct 1040 Connecticut Template

The CT-1040 form is a document that residents of Connecticut use to file their state income tax returns. It is detailed, requiring information about income, tax deductions, credits, and any taxes owed or refunds due for the tax year. Specifically designed for residents, it ensures that individuals comply with state laws by accurately reporting their yearly income and calculating the state tax required. For a smooth filing experience, consider exploring the available electronic filing options, and remember, you can start filling out your form by clicking the button below.

Launch Editor Now

Fill Out a Valid Ct 1040 Connecticut Template

Launch Editor Now

Launch Editor Now

or

Click for Ct 1040 Connecticut PDF

Your form is not complete yet

Edit and complete Ct 1040 Connecticut online in just a few steps.

Single

Single