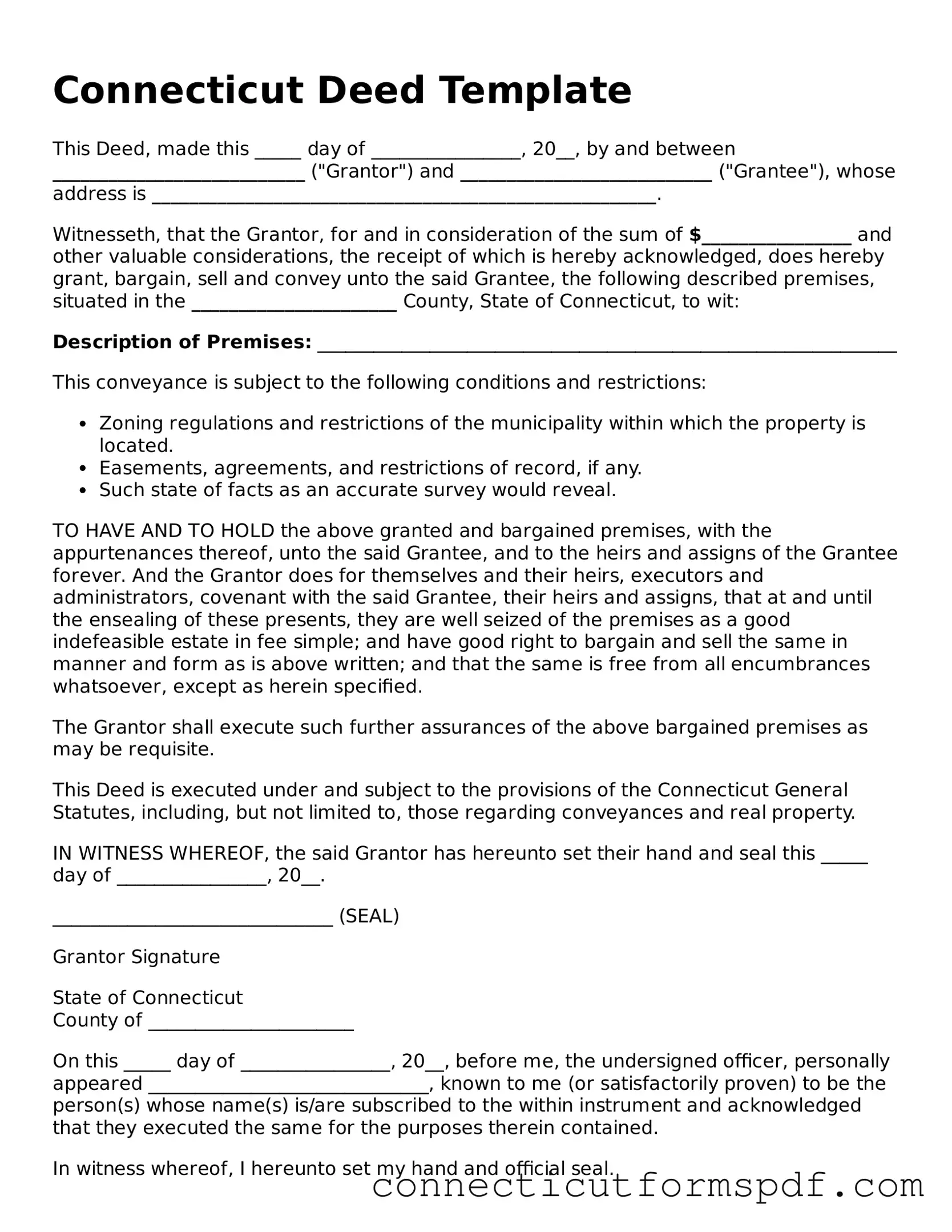

Connecticut Deed Template

This Deed, made this _____ day of ________________, 20__, by and between ___________________________ ("Grantor") and ___________________________ ("Grantee"), whose address is ______________________________________________________.

Witnesseth, that the Grantor, for and in consideration of the sum of $________________ and other valuable considerations, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell and convey unto the said Grantee, the following described premises, situated in the ______________________ County, State of Connecticut, to wit:

Description of Premises: ______________________________________________________________

This conveyance is subject to the following conditions and restrictions:

- Zoning regulations and restrictions of the municipality within which the property is located.

- Easements, agreements, and restrictions of record, if any.

- Such state of facts as an accurate survey would reveal.

TO HAVE AND TO HOLD the above granted and bargained premises, with the appurtenances thereof, unto the said Grantee, and to the heirs and assigns of the Grantee forever. And the Grantor does for themselves and their heirs, executors and administrators, covenant with the said Grantee, their heirs and assigns, that at and until the ensealing of these presents, they are well seized of the premises as a good indefeasible estate in fee simple; and have good right to bargain and sell the same in manner and form as is above written; and that the same is free from all encumbrances whatsoever, except as herein specified.

The Grantor shall execute such further assurances of the above bargained premises as may be requisite.

This Deed is executed under and subject to the provisions of the Connecticut General Statutes, including, but not limited to, those regarding conveyances and real property.

IN WITNESS WHEREOF, the said Grantor has hereunto set their hand and seal this _____ day of ________________, 20__.

______________________________ (SEAL)

Grantor Signature

State of Connecticut

County of ______________________

On this _____ day of ________________, 20__, before me, the undersigned officer, personally appeared ______________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________________

Notary Public

My Commission Expires: __________________