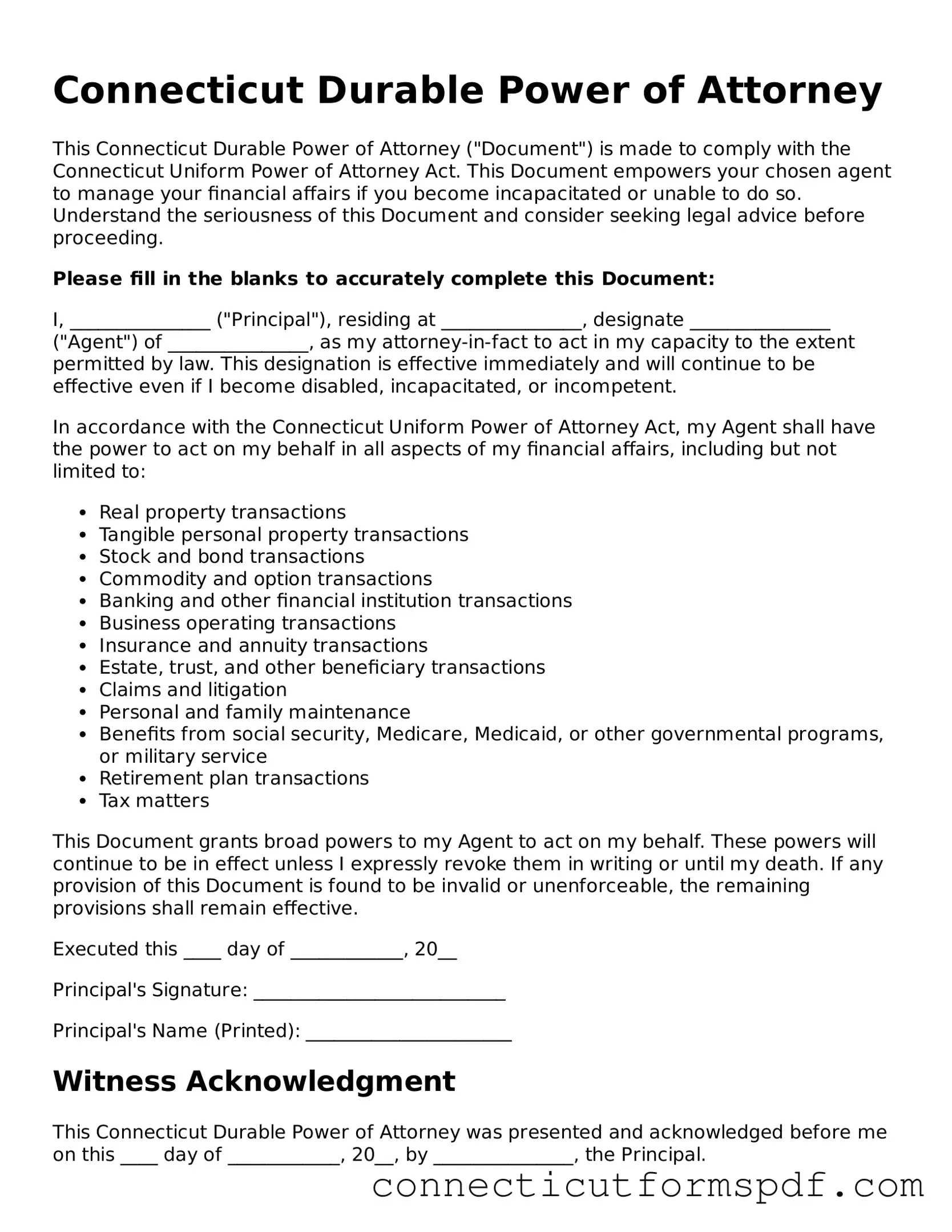

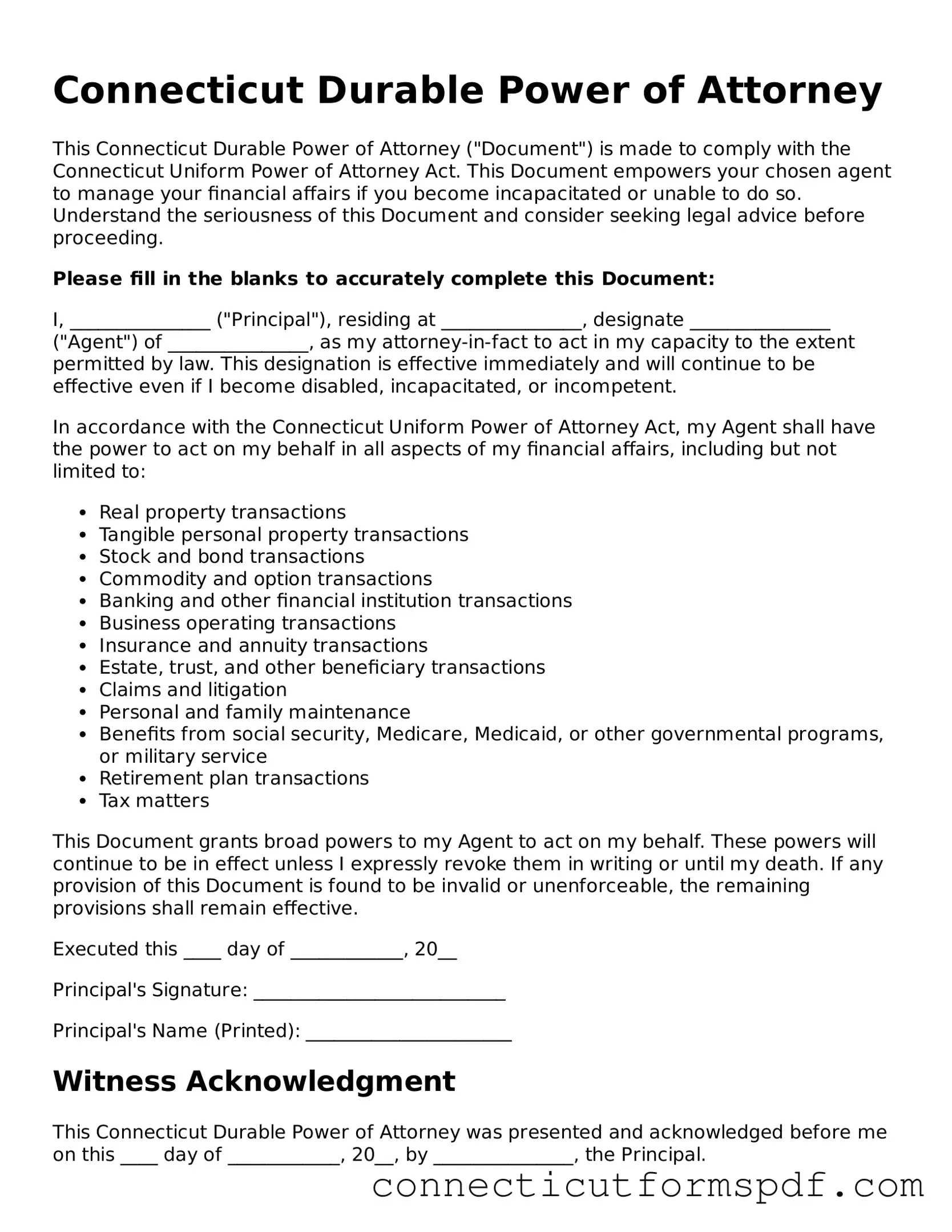

Connecticut Durable Power of Attorney

This Connecticut Durable Power of Attorney ("Document") is made to comply with the Connecticut Uniform Power of Attorney Act. This Document empowers your chosen agent to manage your financial affairs if you become incapacitated or unable to do so. Understand the seriousness of this Document and consider seeking legal advice before proceeding.

Please fill in the blanks to accurately complete this Document:

I, _______________ ("Principal"), residing at _______________, designate _______________ ("Agent") of _______________, as my attorney-in-fact to act in my capacity to the extent permitted by law. This designation is effective immediately and will continue to be effective even if I become disabled, incapacitated, or incompetent.

In accordance with the Connecticut Uniform Power of Attorney Act, my Agent shall have the power to act on my behalf in all aspects of my financial affairs, including but not limited to:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

This Document grants broad powers to my Agent to act on my behalf. These powers will continue to be in effect unless I expressly revoke them in writing or until my death. If any provision of this Document is found to be invalid or unenforceable, the remaining provisions shall remain effective.

Executed this ____ day of ____________, 20__

Principal's Signature: ___________________________

Principal's Name (Printed): ______________________

Witness Acknowledgment

This Connecticut Durable Power of Attorney was presented and acknowledged before me on this ____ day of ____________, 20__, by _______________, the Principal.

Witness Signature: ___________________________

Witness's Name (Printed): ______________________

State of Connecticut County of __________________

Subscribed and sworn to (or affirmed) before me this ____ day of ____________, 20__, by _______________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: ___________________________

My commission expires: ___________________