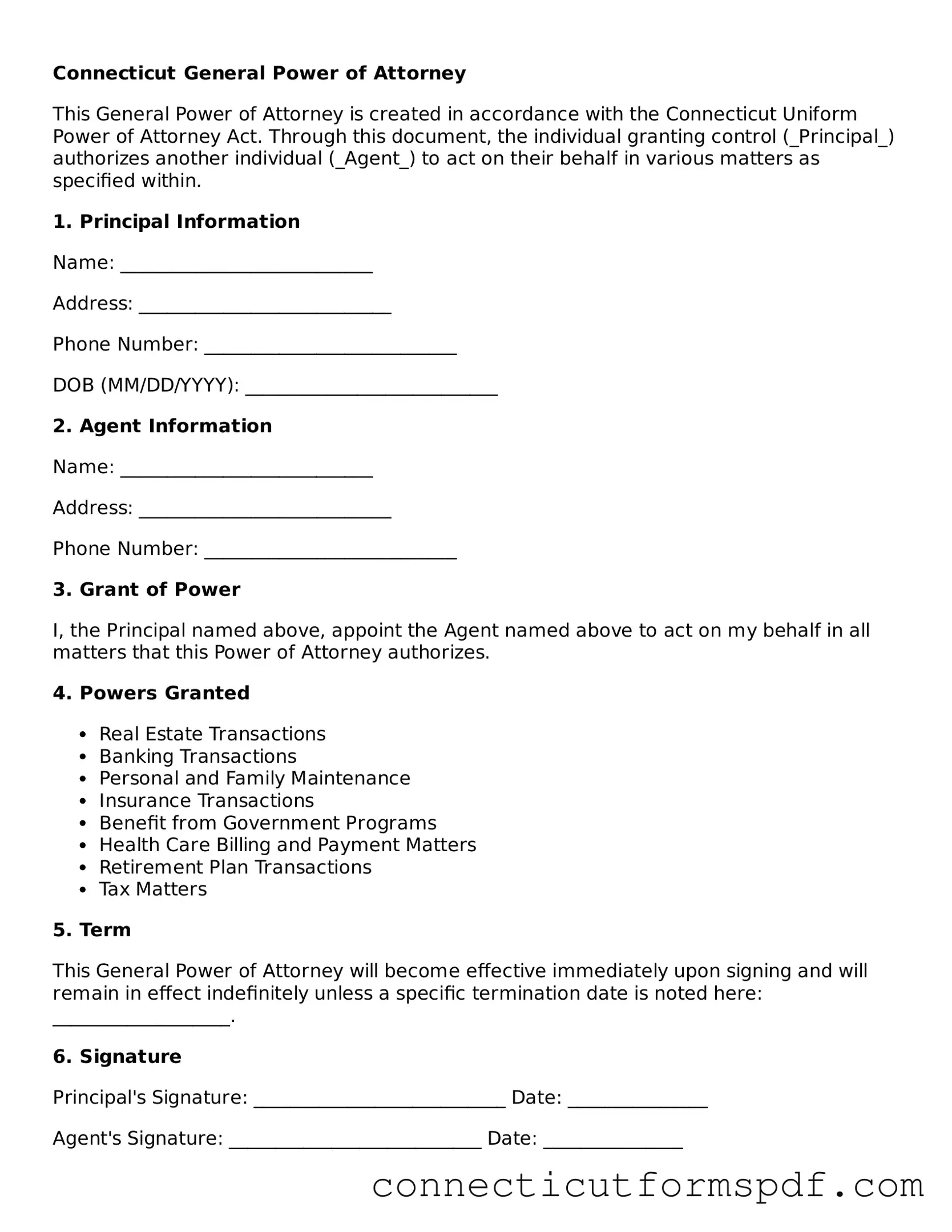

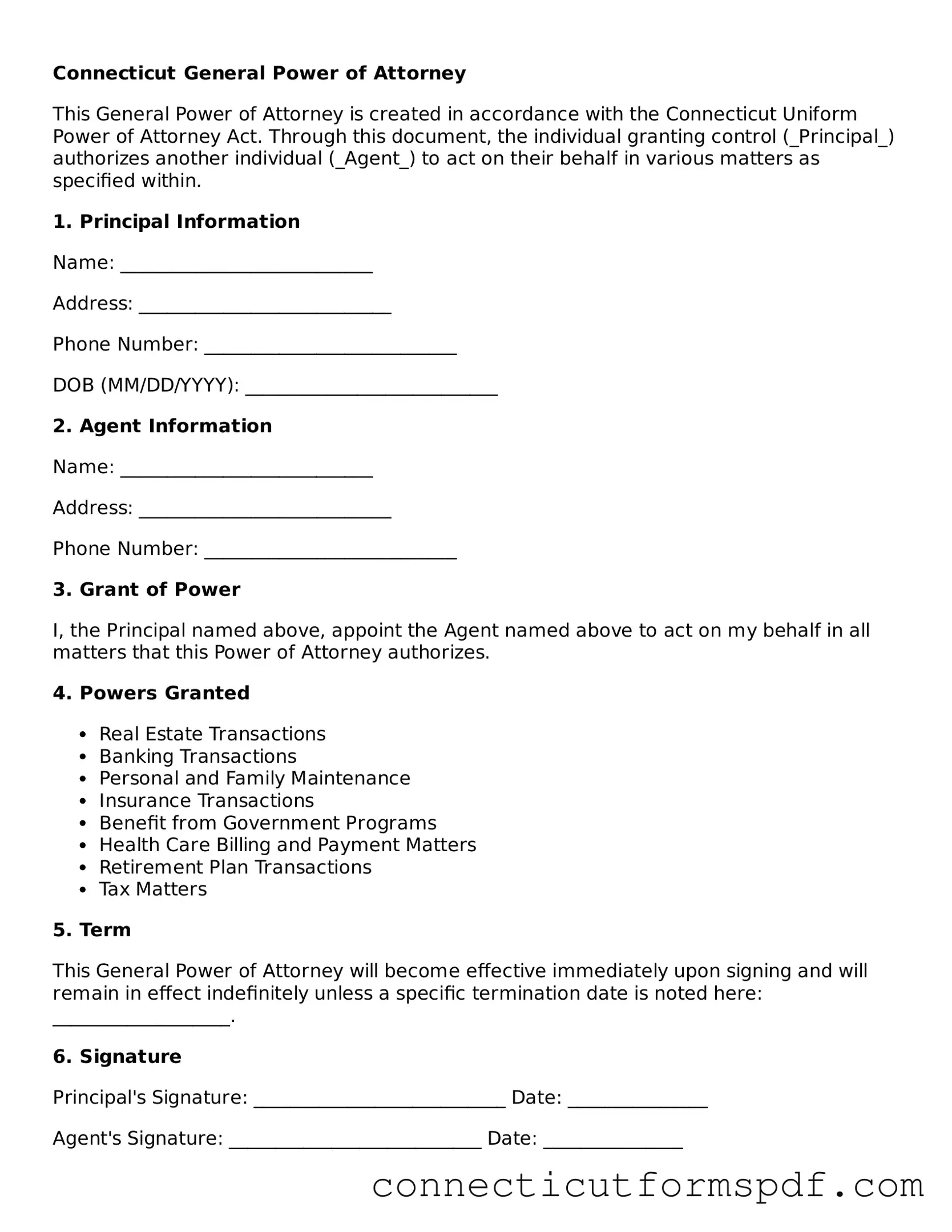

Connecticut General Power of Attorney Form

The Connecticut General Power of Attorney form is a legal document that allows one person, known as the principal, to delegate their financial affairs to another individual, known as the agent or attorney-in-fact. This agreement grants the agent broad authority to act on the principal's behalf, covering a wide range of financial decisions and actions. To ensure your financial matters are handled as you wish, consider filling out the Connecticut General Power of Attorney form by clicking the button below.

Launch Editor Now

Connecticut General Power of Attorney Form

Launch Editor Now

Launch Editor Now

or

Click for General Power of Attorney PDF

Your form is not complete yet

Edit and complete General Power of Attorney online in just a few steps.