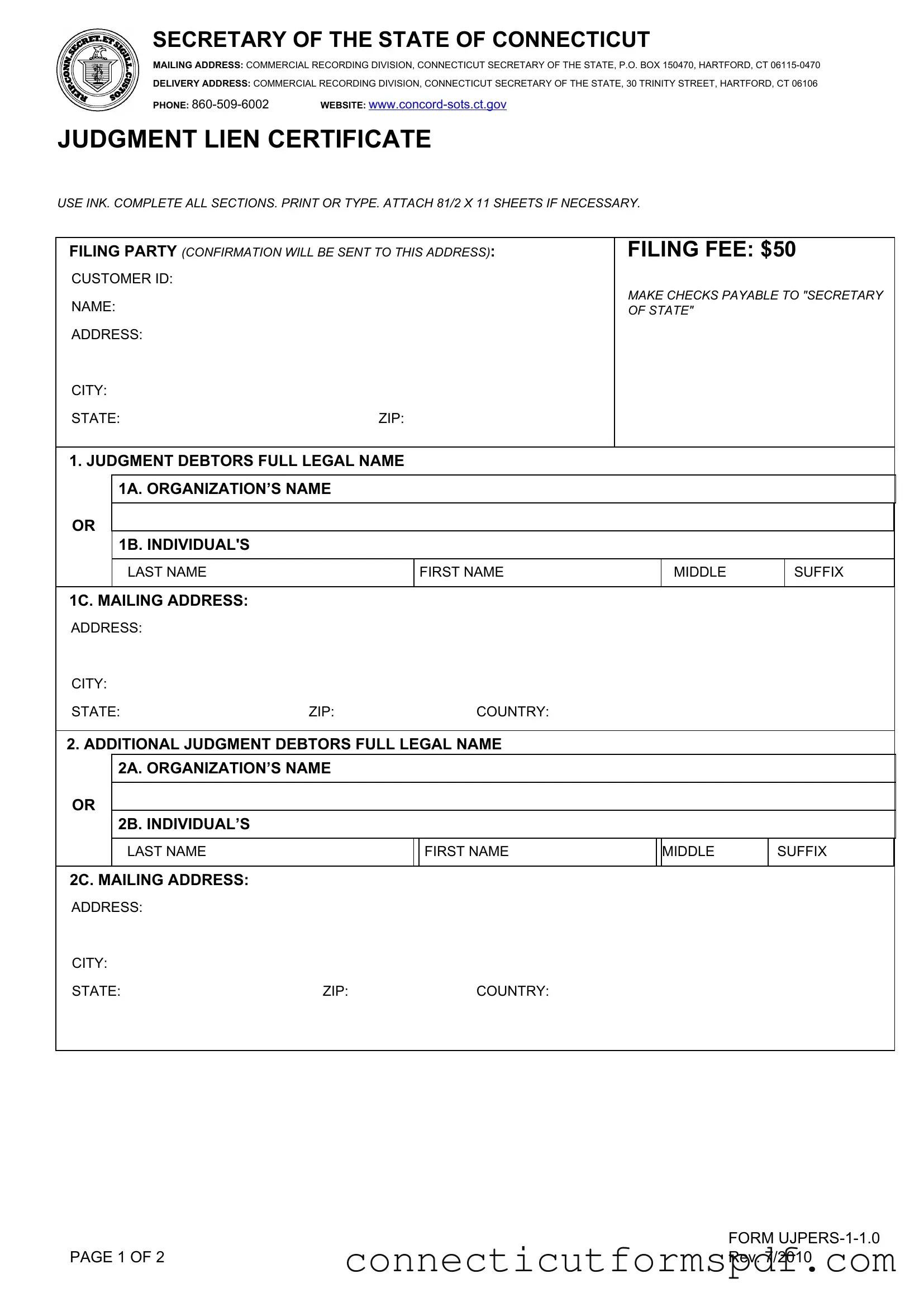

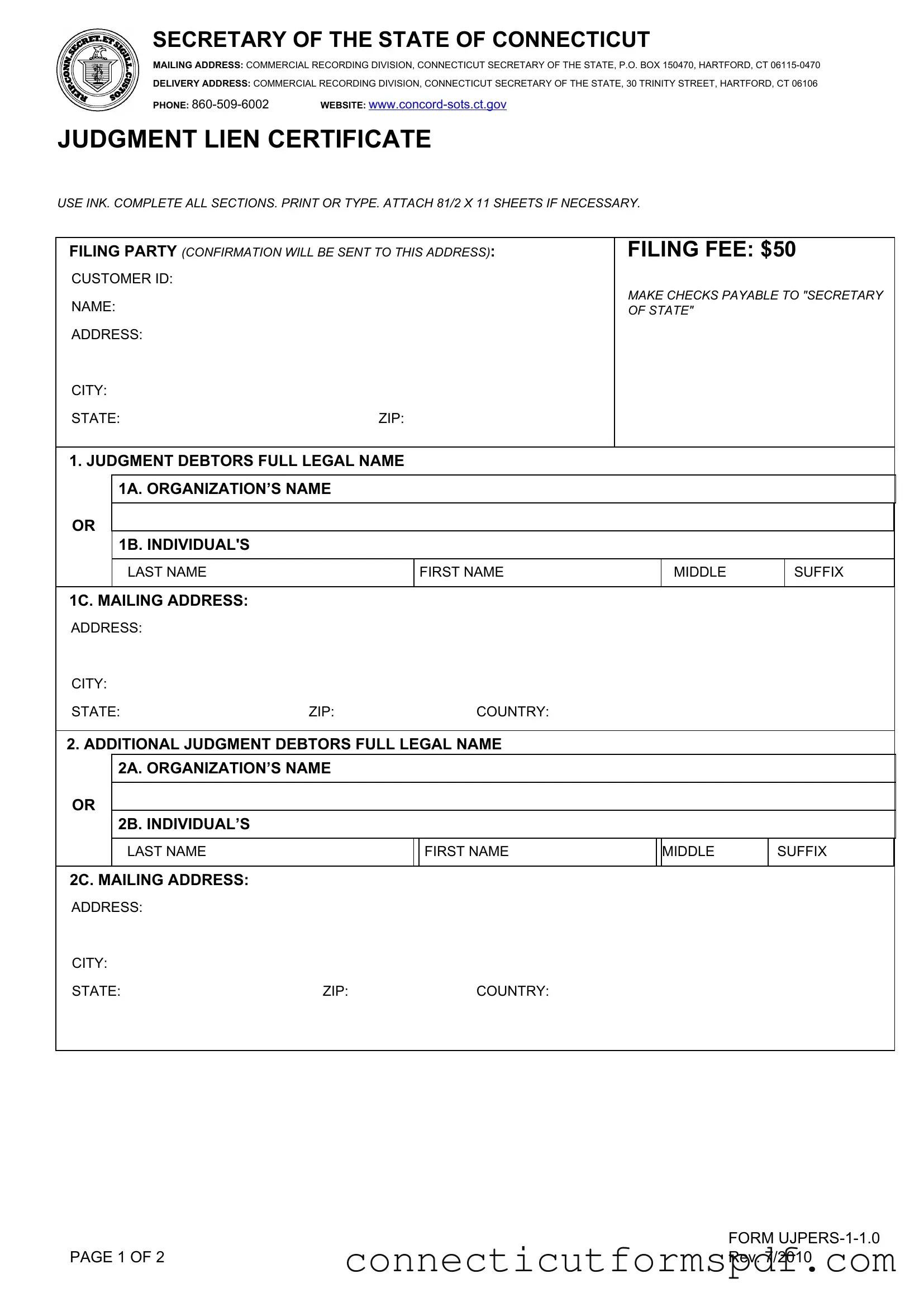

Fill Out a Valid Judgment Lien Certificate Connecticut Template

The Judgment Lien Certificate Connecticut form serves as a critical tool for creditors to secure their interest in a debtor's property in the event of a judgment. Issued by the Secretary of the State of Connecticut, this document formalizes a lien against personal property of the judgment debtor, ensuring that the creditor has a claim recognized by the state. To safeguard financial interests and enforce collection on outstanding judgments, creditors must meticulously complete and submit this form, along with the required fee. Click the button below to start filling out your form.

Launch Editor Now

Fill Out a Valid Judgment Lien Certificate Connecticut Template

Launch Editor Now

Launch Editor Now

or

Click for Judgment Lien Certificate Connecticut PDF

Your form is not complete yet

Edit and complete Judgment Lien Certificate Connecticut online in just a few steps.