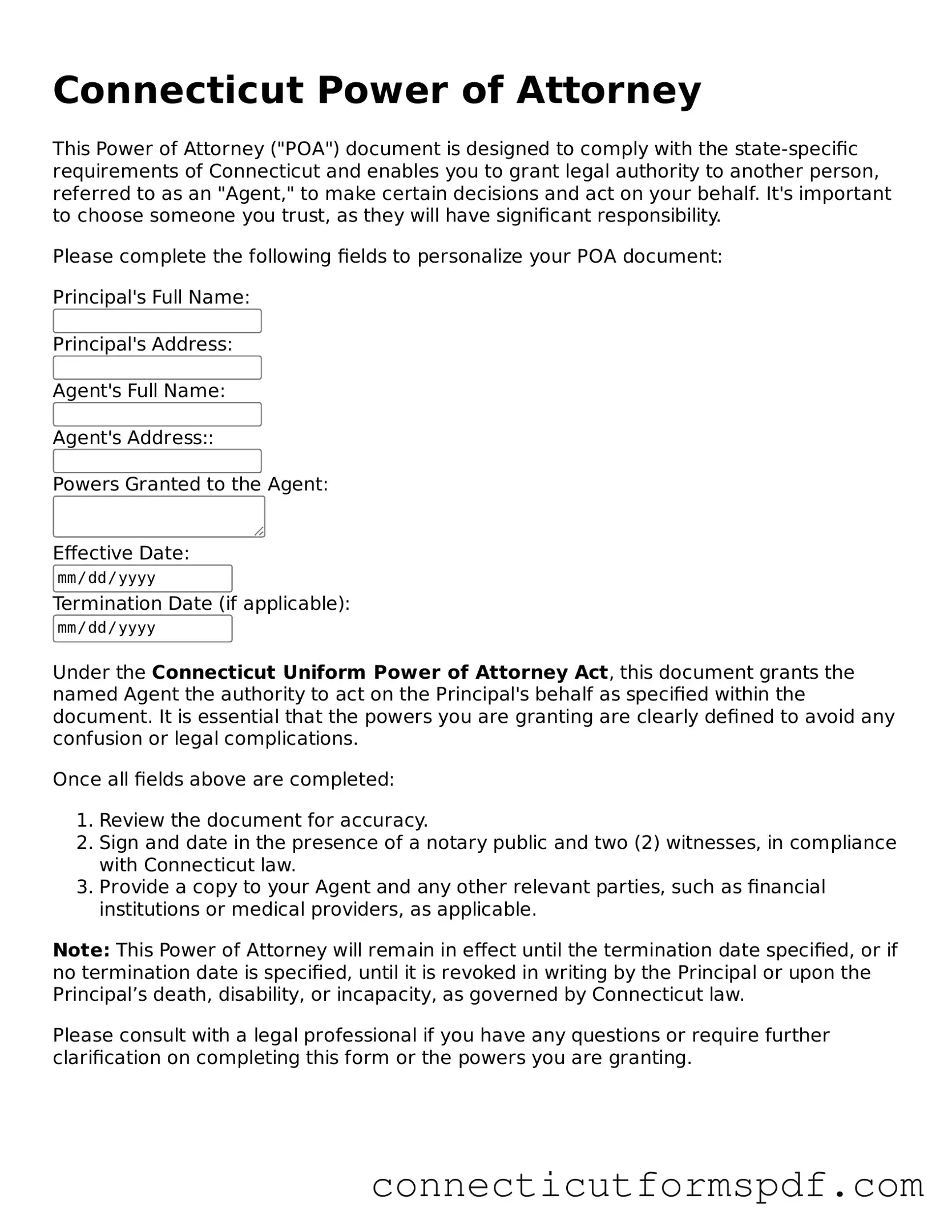

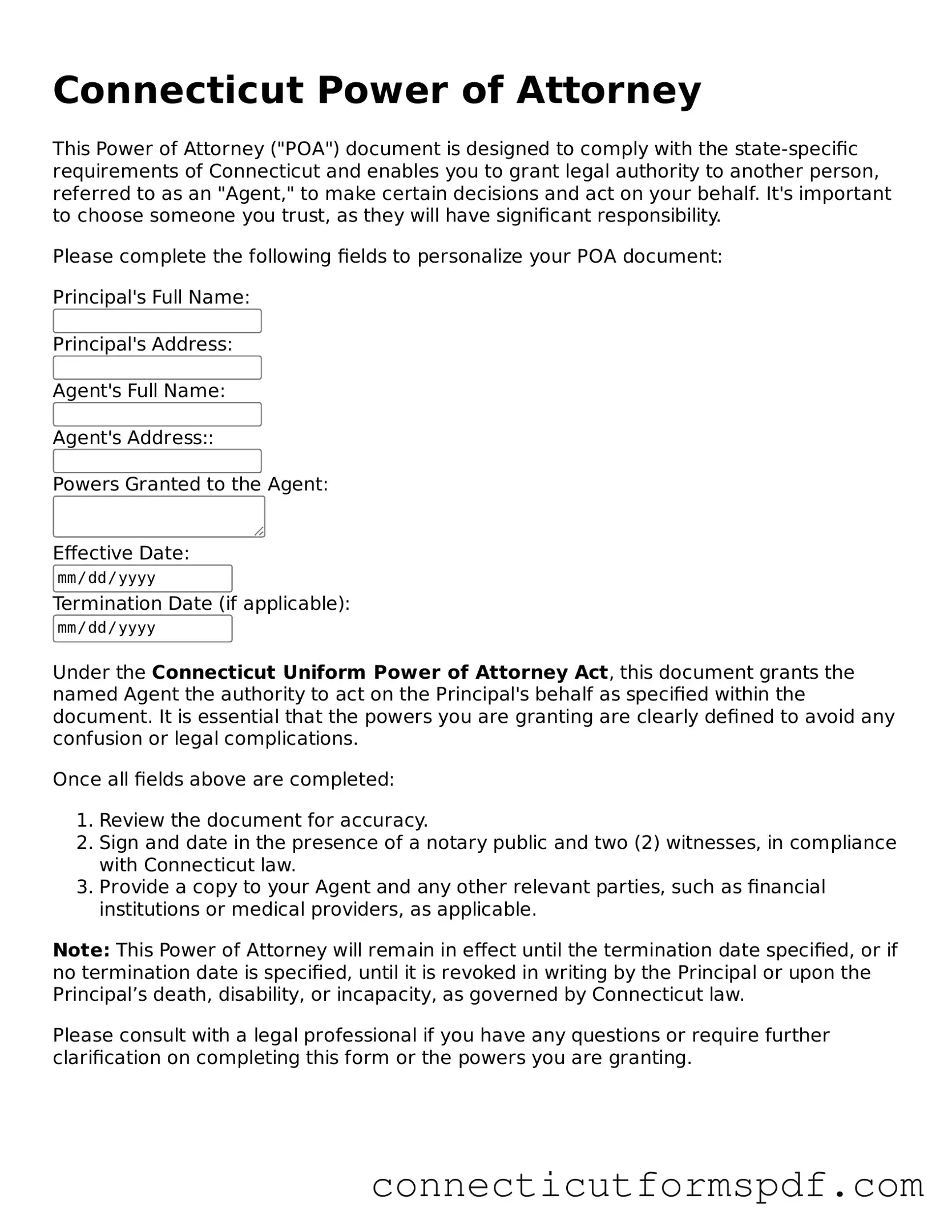

Connecticut Power of Attorney Form

A Connecticut Power of Attorney form is a legal document that lets you appoint someone to handle your affairs if you're unable to do so yourself. This might cover financial, legal, or health-related decisions. Whether you're planning for the future or facing a current need, completing this form ensures your affairs can be managed by someone you trust. Ready to take this important step? Click the button below to get started.

Launch Editor Now

Connecticut Power of Attorney Form

Launch Editor Now

Launch Editor Now

or

Click for Power of Attorney PDF

Your form is not complete yet

Edit and complete Power of Attorney online in just a few steps.