In the state of Connecticut, when parties enter into the agreement of a promissory note, a structured approach is required to ensure both the borrower and the lender are protected under the law. However, common mistakes can occur during the process of filling out a Connecticut Promissory Note form. These errors, albeit often made without malice, can lead to significant complications, misunderstandings, or legal challenges down the line.

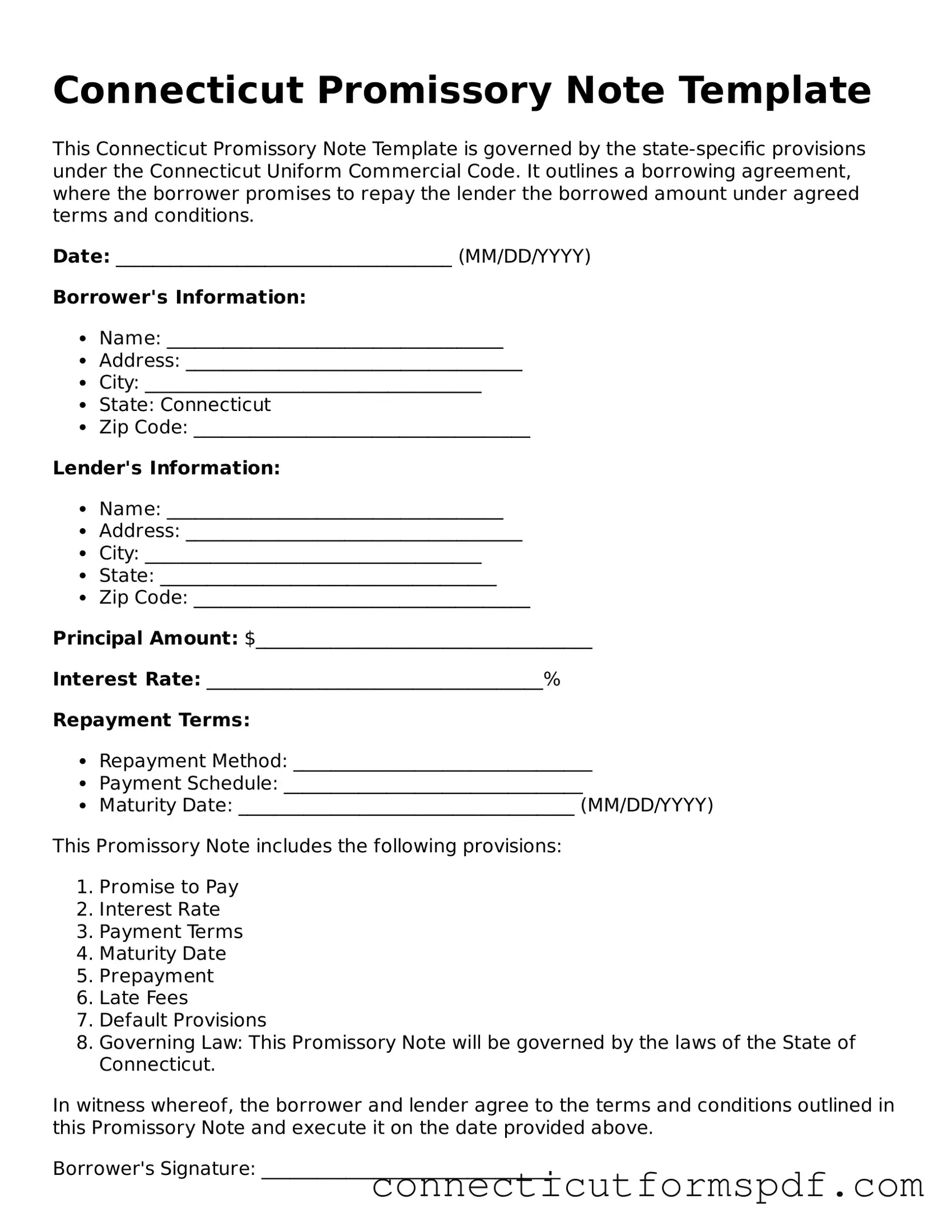

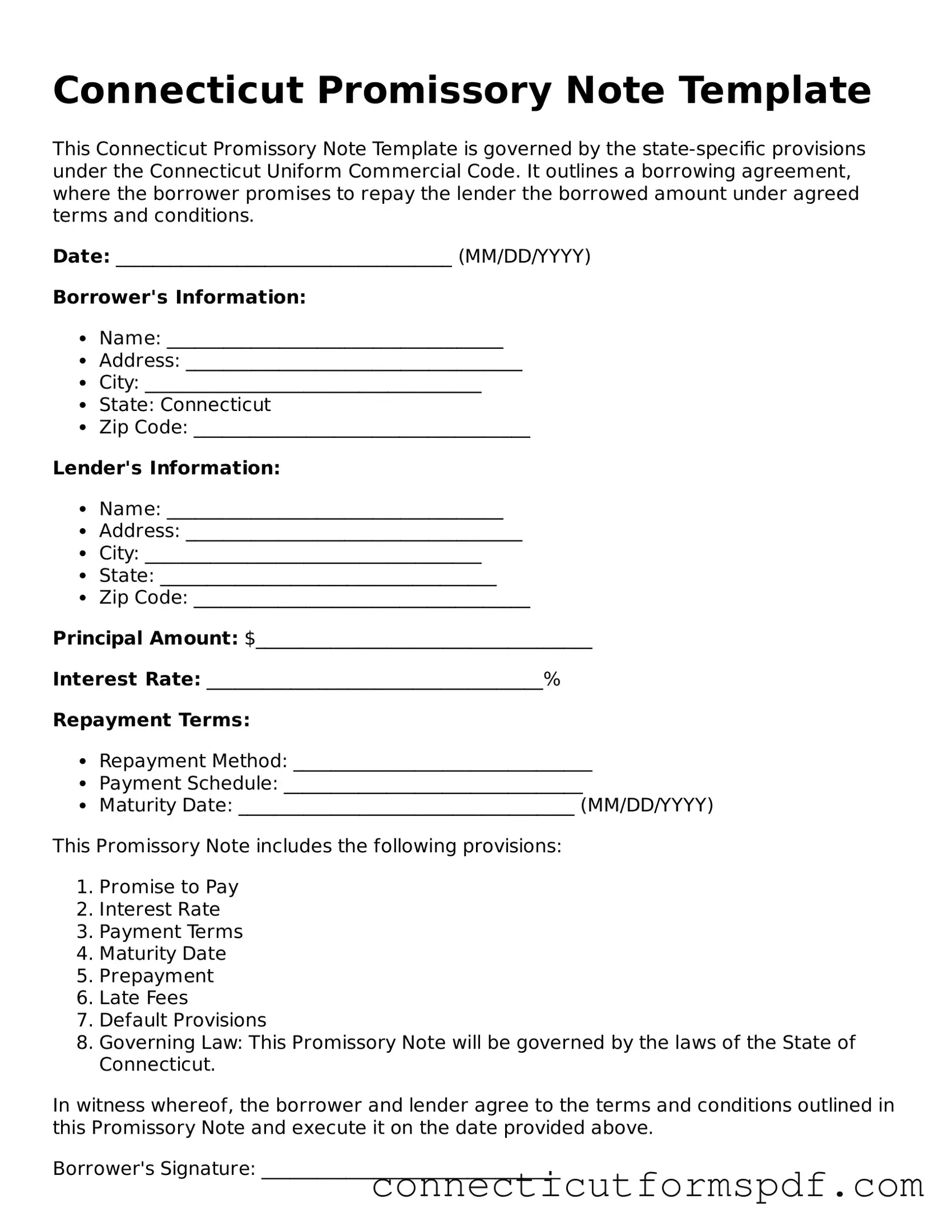

One of the initial mistakes made includes neglecting to clearly identify the parties involved. It is crucial that the legal names of both the borrower and the lender are accurately stated, including any co-signers. An ambiguous identification can make it difficult to enforce the note, should the need arise.

Another frequent oversight is failing to specify the loan amount clearly. This figure should be written in both words and numbers to avoid any discrepancies. Additionally, the terms of repayment, including the schedule, interest rates, and the final due date, must be delineated with precision. Any ambiguity in these areas can lead to disputes or unintended financial obligations.

Often, parties also make the mistake of not defining the interest rate or neglecting to state whether it is fixed or variable. In Connecticut, if the interest rate is not specified, the default rate becomes the rate that is legally permissible under state law, which might not be favorable for one of the parties. Furthermore, the promissory note should explicitly state the consequences of a late payment or non-payment, including any fees or penalties. Without this, enforcing penalties can become problematic.

Overlooking the inclusion of security agreements, if applicable, is another error. A promissory note can be either secured or unsecured. If it's secured, this means that the borrower has agreed to put up collateral to guarantee the loan. Failure to properly describe the security interest or collateral can lead to difficulties in claiming the collateral if the borrower defaults.

Other common missteps include:

- Not having the document witnessed or notarized, where required. This can affect the legal enforceability of the note.

- Use of vague or informal language that does not hold legal weight or is open to interpretation.

- Forgetting to provide a copy of the completed promissory note to both the lender and the borrower, leading to potential disputes about the terms agreed upon.

- Ignoring state-specific legal requirements or assuming that general legal principles will apply without consulting local statutes or a legal advisor.

Addressing these mistakes requires a meticulous approach to completing the Connecticut Promissory Note form. Both parties should review the document in its entirety, ensuring every section is filled out accurately and reflects their agreement. Consultation with a legal professional is advisable to prevent any issues that may arise from an incorrectly filled out form. By paying close attention to these details, parties can solidify their agreement in a manner that upholds their rights and intentions within the framework of Connecticut law.