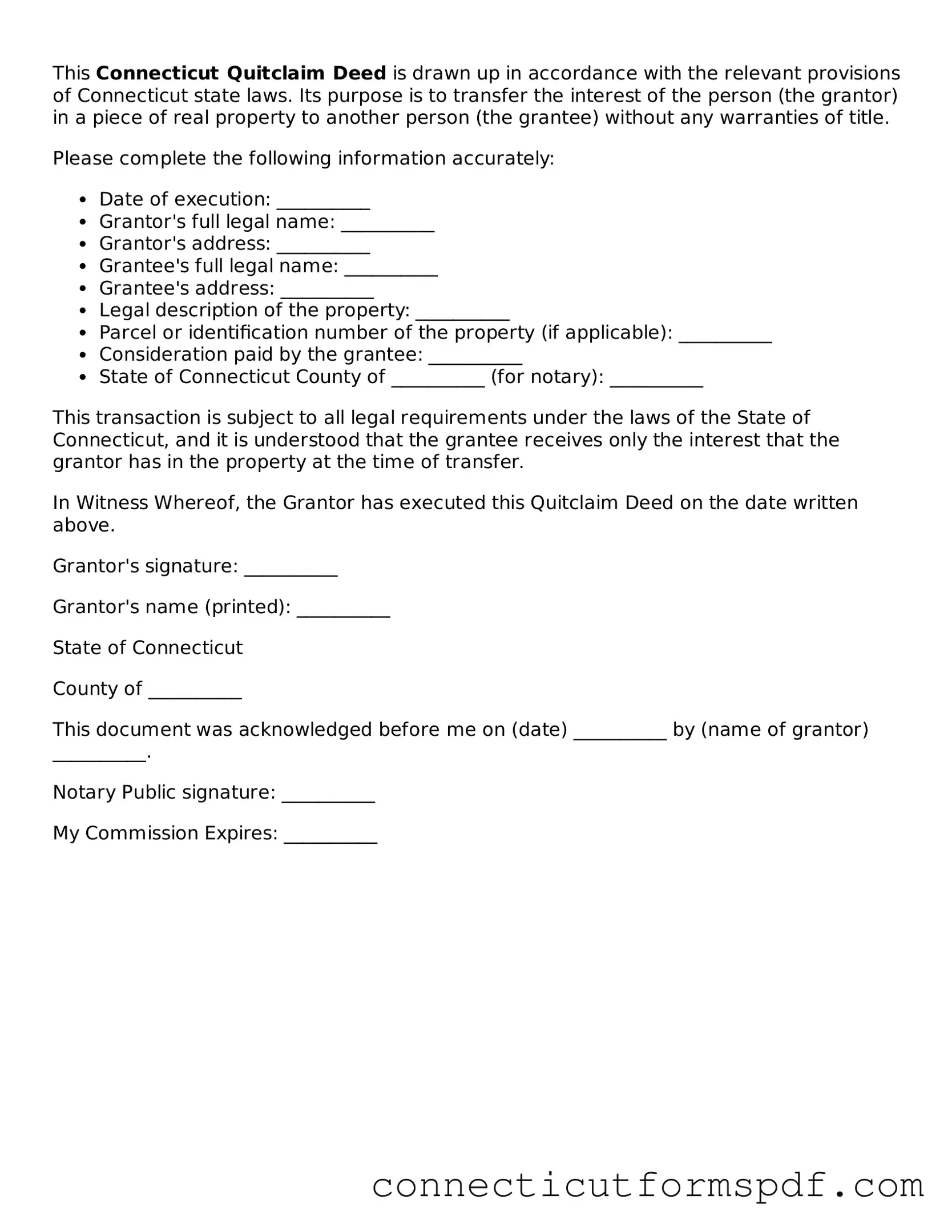

Connecticut Quitclaim Deed Form

A Connecticut Quitclaim Deed form is a legal document used to transfer interest, or ownership, in real property from a seller, known as the grantor, to a buyer, known as the grantee, without any warranty that the title is clear. This means that the grantor does not guarantee that they own the property free and clear of all liens and encumbrances. To securely and efficiently handle your property transfer needs in Connecticut using this form, click the button below.

Launch Editor Now

Connecticut Quitclaim Deed Form

Launch Editor Now

Launch Editor Now

or

Click for Quitclaim Deed PDF

Your form is not complete yet

Edit and complete Quitclaim Deed online in just a few steps.