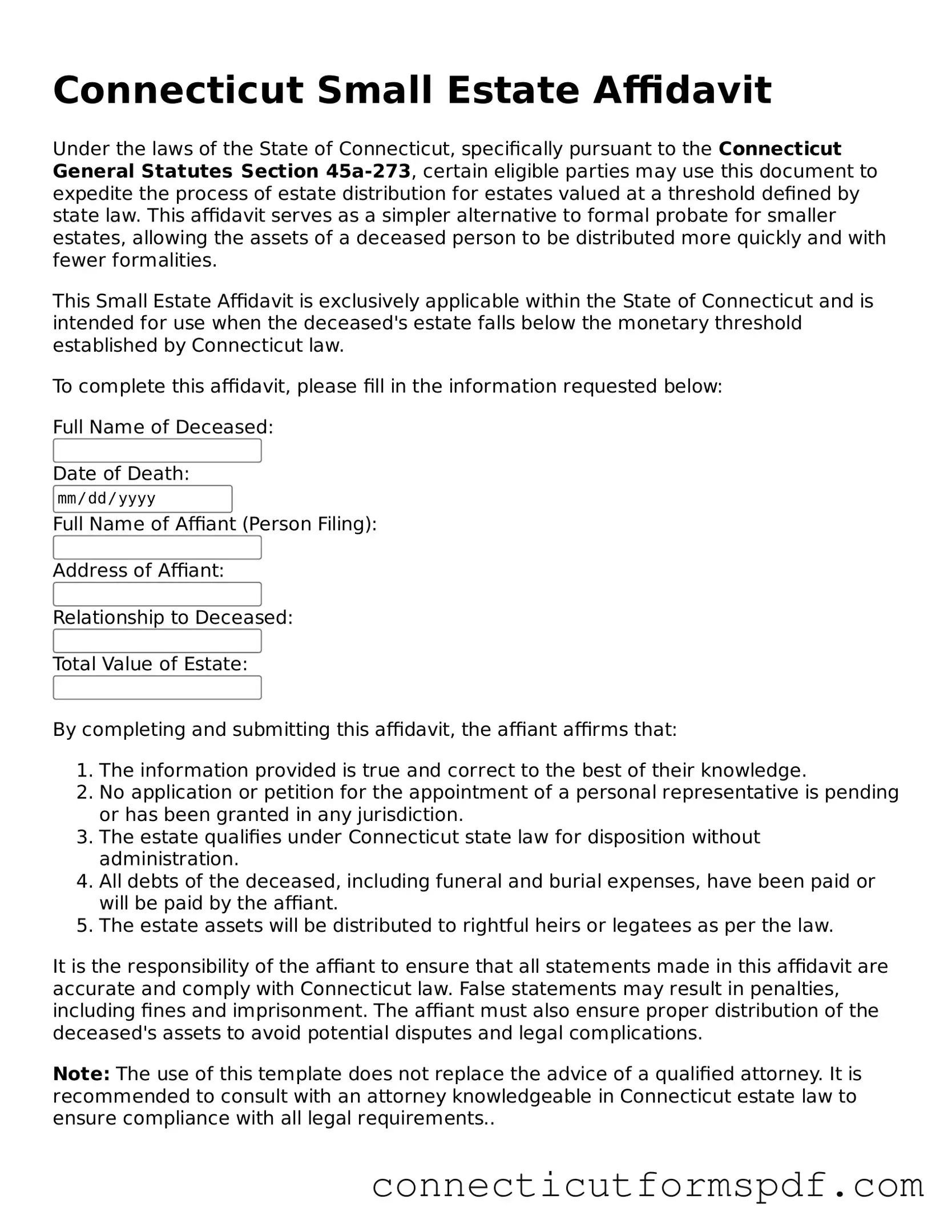

Connecticut Small Estate Affidavit Form

The Connecticut Small Estate Affidavit form is a legal instrument allowing for the simplified transfer of assets from a deceased’s estate to beneficiaries, provided the value of the estate falls below a specific threshold. This framework is designed to circumvent the often complex and time-consuming probate process, thus facilitating a more streamlined approach to estate settlement. For individuals navigating the disposition of a loved one’s assets, understanding and completing this form correctly is essential.

To get started with filling out the Connecticut Small Estate Affidavit form, click the button below.

Launch Editor Now

Connecticut Small Estate Affidavit Form

Launch Editor Now

Launch Editor Now

or

Click for Small Estate Affidavit PDF

Your form is not complete yet

Edit and complete Small Estate Affidavit online in just a few steps.