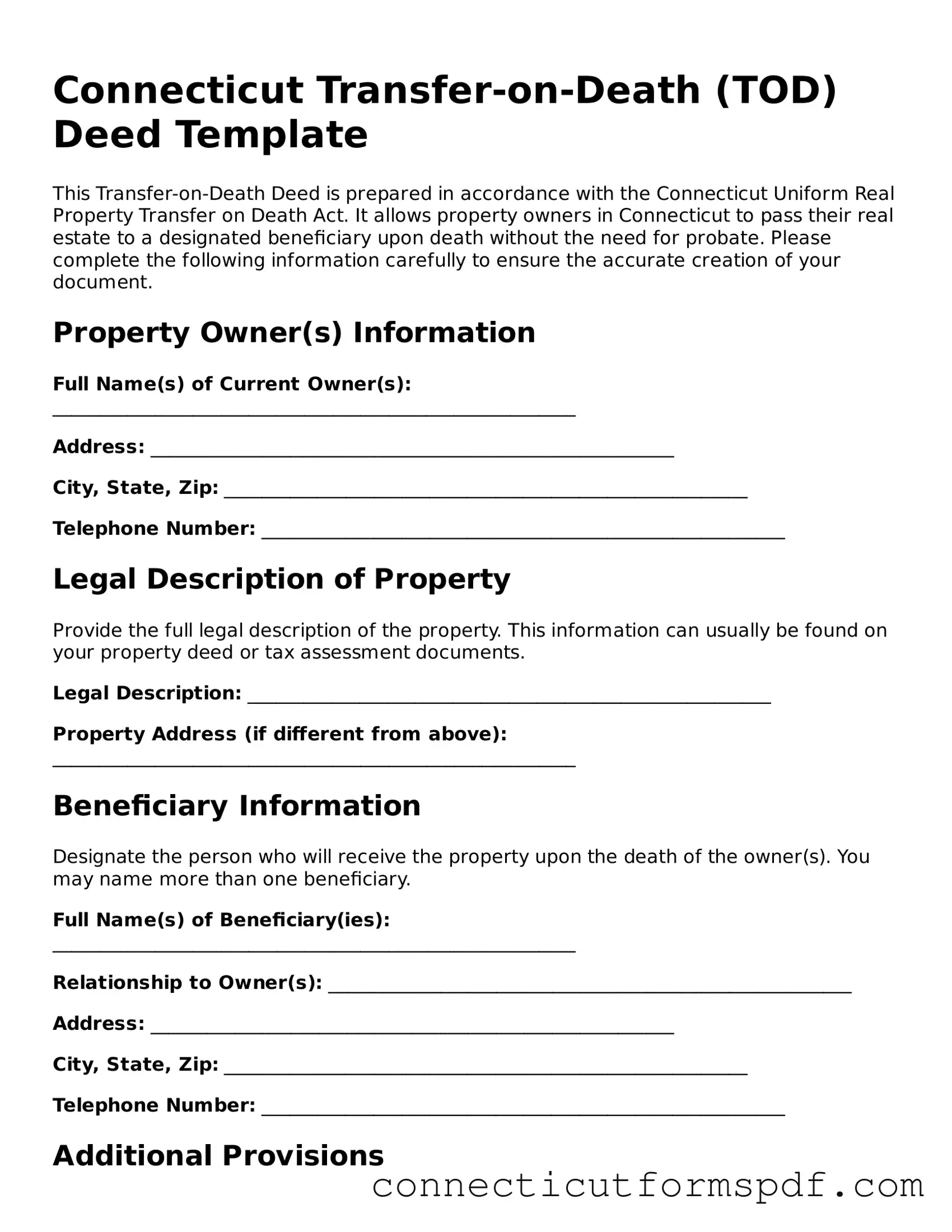

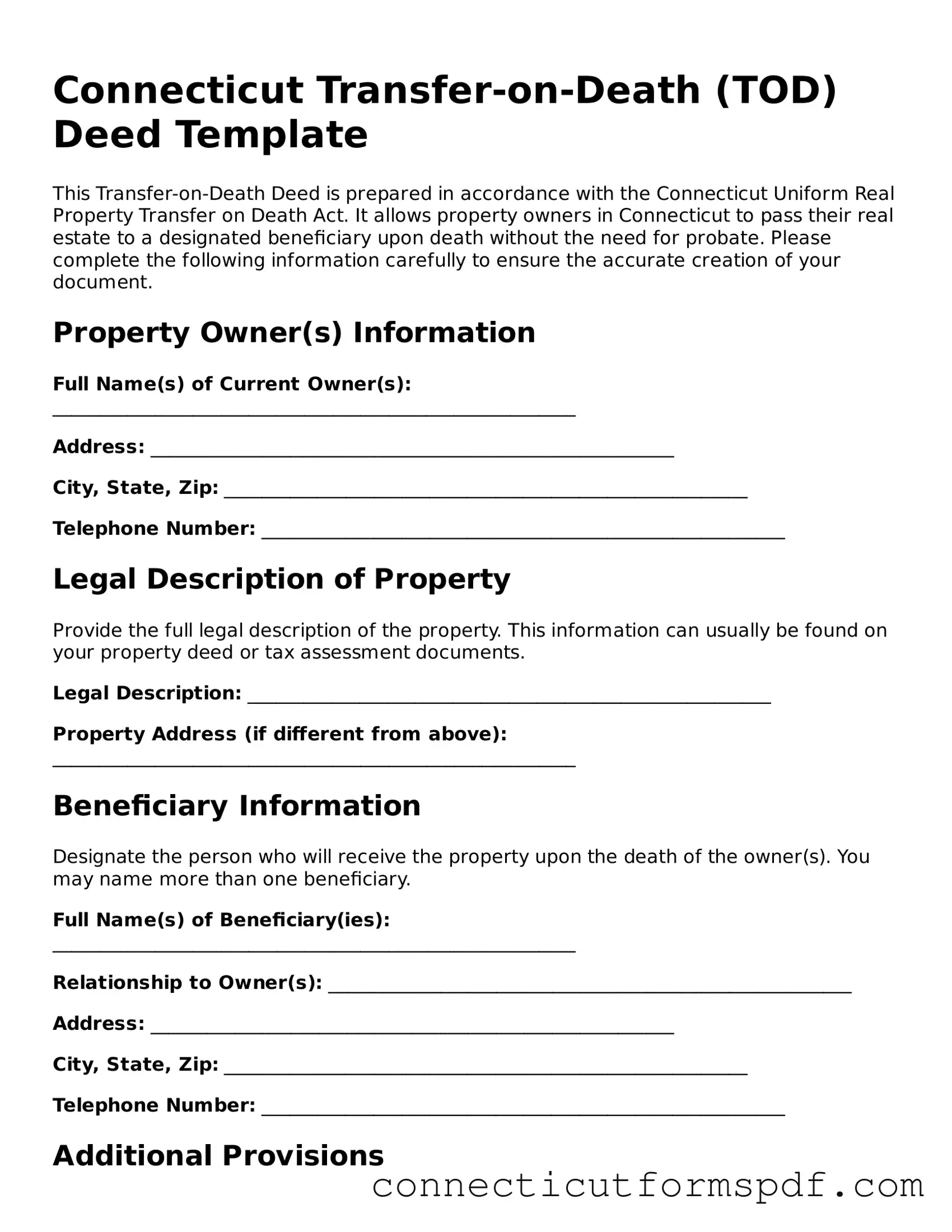

Connecticut Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed is prepared in accordance with the Connecticut Uniform Real Property Transfer on Death Act. It allows property owners in Connecticut to pass their real estate to a designated beneficiary upon death without the need for probate. Please complete the following information carefully to ensure the accurate creation of your document.

Property Owner(s) Information

Full Name(s) of Current Owner(s): ________________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________________

Telephone Number: ________________________________________________________

Legal Description of Property

Provide the full legal description of the property. This information can usually be found on your property deed or tax assessment documents.

Legal Description: ________________________________________________________

Property Address (if different from above): ________________________________________________________

Beneficiary Information

Designate the person who will receive the property upon the death of the owner(s). You may name more than one beneficiary.

Full Name(s) of Beneficiary(ies): ________________________________________________________

Relationship to Owner(s): ________________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________________

Telephone Number: ________________________________________________________

Additional Provisions

If there are specific conditions or limitations you wish to apply to this transfer, list them below. It’s recommended to consult with a legal professional to ensure these provisions comply with Connecticut law and do not invalidate your deed.

Provisions: ________________________________________________________

Execution

To be valid, this Transfer-on-Death Deed must be signed in the presence of a notary public.

Owner(s) Signature: ________________________________________________________

Date: ________________________________________________________

This document must be notarized and recorded with the appropriate Connecticut county recorder’s office before it becomes effective.

Notary Public

State of Connecticut

County of: ________________________

On ________________________, before me, ________________________ (notary public), personally appeared ________________________, proven to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Notary Signature: ________________________

Date: ________________________

My commission expires: ________________________